Analysis of the Effectiveness of PR Earnings Yield in Dividend Index Investment and Valuation Opportunities

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

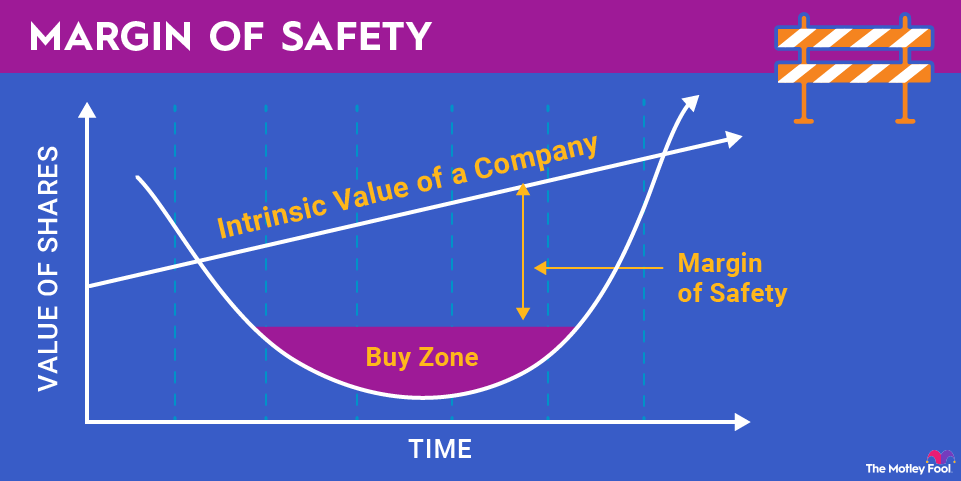

PR Earnings Yield is a non-standardized value-oriented valuation method whose core logic derives from Buffett’s margin of safety theory—investors should buy when asset prices are significantly lower than intrinsic value to reduce downside risk [0]. For dividend index investment, this method has theoretical adaptability: dividend indices typically consist of mature enterprises with stable earnings and consistent dividend policies, making their intrinsic value calculations relatively reliable, and the margin of safety strategy helps avoid overvaluation risks. However, the effectiveness of PR Earnings Yield highly depends on the accuracy of its calculation method, the maintenance of the index’s earnings stability, and the impact of market conditions on the price-intrinsic value relationship.

The dividend indices focused on in the current query (CSI All-Share Dividend Quality, CSI Dividend Value, Smart Selection High Dividend, etc.) meet the basic conditions for applying PR Earnings Yield, but due to external data tool limitations, we cannot obtain their current PR valuation levels or determine if they fall within the 0.4-0.5 buying range. Note that PR Earnings Yield is not a mainstream standardized financial indicator; the transparency and consistency of its calculation method are key considerations for application.

PR Earnings Yield is a valuation tool consistent with value investment concepts, theoretically applicable to dividend index investment, but needs to be evaluated based on its specific calculation method and the index’s actual valuation level. Due to current data limitations, we cannot provide real-time PR valuations and investment opportunity conclusions for the mentioned specific dividend indices. Investors should focus on the transparency of calculation rules and dynamic market environment changes when applying this method.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.