Investor Rotating PLTR Gains to AMD: Tech Rotation and Home Investment Analysis

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

The investor’s strategy is rooted in two intersecting themes: technology sector dynamics and personal investment goal alignment. Palantir Technologies (PLTR) traded at a 2021 open price of $23.91 but declined 73.15% by 2022’s end, leaving the investor underwater for two years [0]. From 2023 to December 2025, PLTR rallied 2838.91% to $193.38, driven by AI demand and government/enterprise contract growth, with the investor’s 900% gain likely reflecting a specific entry/exit window (e.g., buying near ~$17.50 and selling near ~$175) [0].

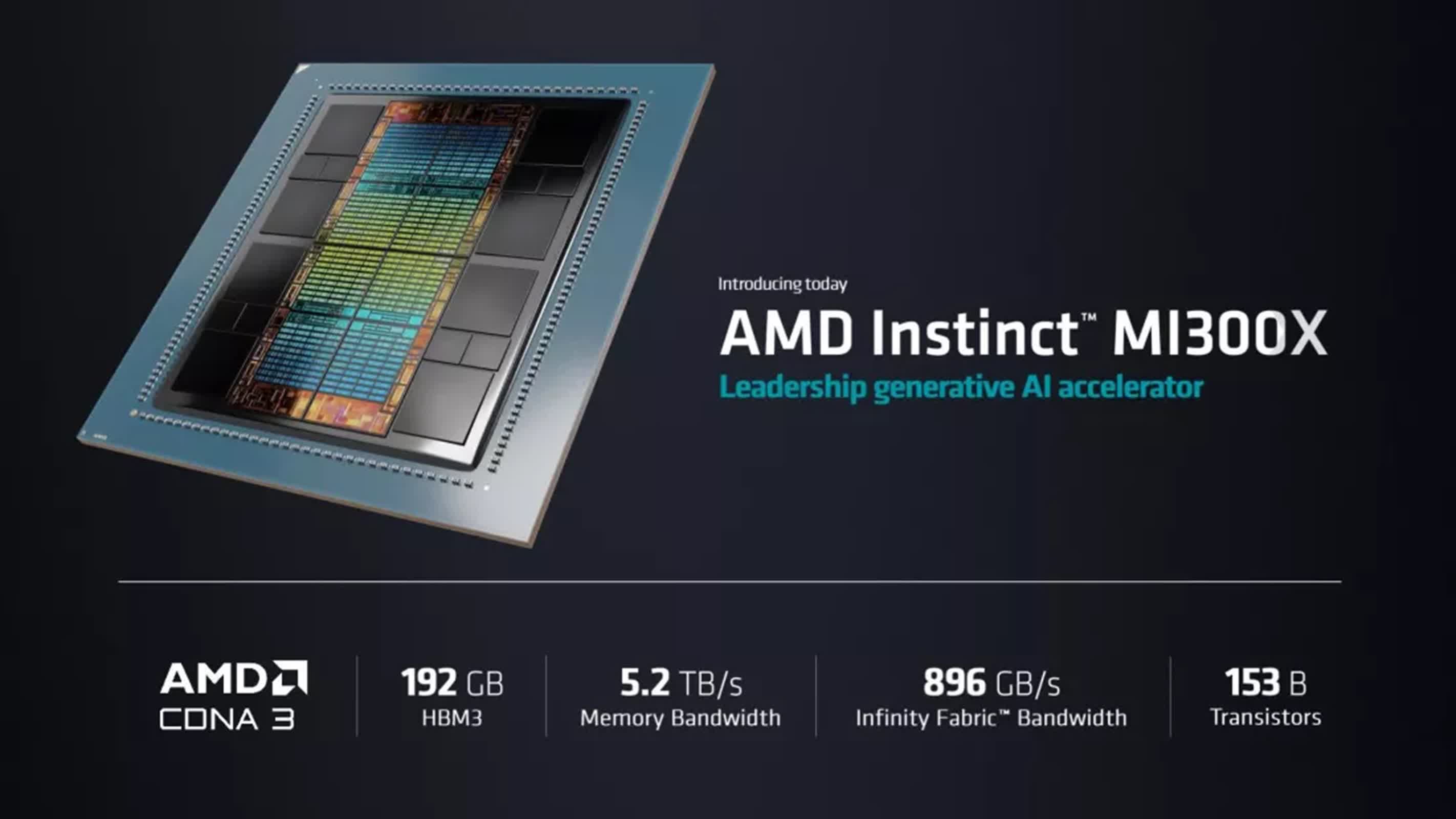

In contrast, Advanced Micro Devices (AMD) grew 223.39% from a 2023 open of $66.00 to $213.43 by December 2025, supported by accelerating AI semiconductor demand and infrastructure buildouts [0][1]. This shift reflects a broader 2025 tech sector rotation: PLTR faced late-2025 valuation concerns (high price-to-sales multiples and a 19% November 2025 correction amid profit-taking) [2], while investors moved to AI hardware like AMD for more tangible growth drivers and perceived stability [3].

On the personal finance front, the strategy aligns with expert recommendations: a 5-year timeline for stock investments before accessing funds for major purchases to weather volatility [4]. The investor’s move from PLTR to AMD (or capital preservation) protects the down payment from market downturns, a prudent step for a time-sensitive goal like home ownership.

- Tech Sector Rotation Pattern: The shift from PLTR (AI software) to AMD (AI hardware) mirrors 2025 market preference for tangible AI infrastructure with visible demand, as investors avoided frothy valuations in high-growth software stocks [3].

- Goal-Driven Risk Adjustment: Reallocating gains to fund a home down payment demonstrates the importance of aligning investment risk profiles with the proximity of life goals—shifting from growth to capital preservation for near-term objectives [4].

- Unverified Entry/Exit Details: The exact PLTR entry point for the 900% gain is unconfirmed; the broader rally suggests plausibility but depends on timing [0].

- AMD Demand Volatility: AMD’s performance relies on sustained AI demand, which could be impacted by U.S.-China tech policy, supply chain constraints, or competition [1].

- Home Market Variables: Mortgage rates, home price trends, and down payment requirements may affect the sufficiency of reallocated funds [0].

- AMD AI Tailwinds: Ongoing AI memory and infrastructure demand could support continued AMD growth, potentially enhancing the down payment fund’s value if timing aligns [1].

The investor’s strategy leverages PLTR’s late-stage rally gains, capitalizes on AMD’s AI hardware momentum, and aligns with personal finance best practices for protecting capital for major purchases. This reflects broader tech sector rotation patterns in 2025 and the importance of adjusting investment strategies based on time-sensitive life goals, though uncertainties remain regarding entry/exit specifics and future market conditions.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.