雪球三分法组合策略的风险收益表现与全球资产配置价值分析

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

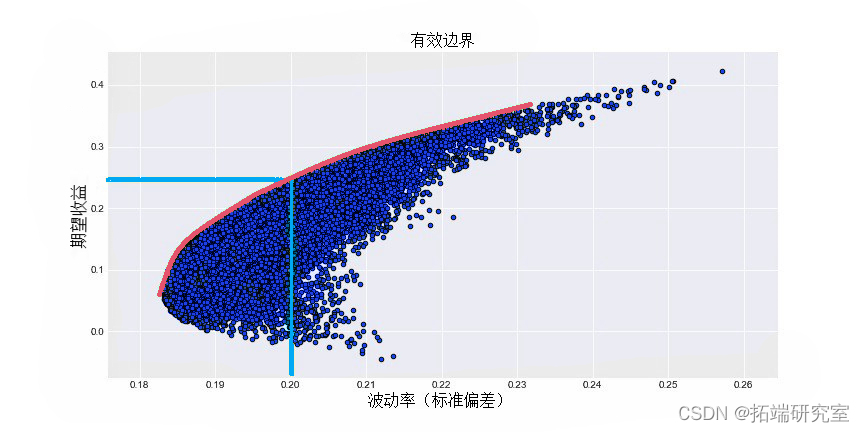

雪球三分法组合策略以资产分散(股、债、商)、市场分散(A股、港股、美股)、时间分散(定投)为核心框架[1][2][3][4][5]。根据公开回测和实盘数据,策略年化波动率约7.3%-9%,仅为A股主流指数的一半;长期最大回撤低于15%,2025年实盘用户平均最大回撤仅4.1%,远优于沪深300和标普500的同期表现[1][2]。收益方面,策略长期年化收益率约7%,兼顾稳健性与增值性[1][2]。

该策略的核心价值在于三维分散逻辑与资产相关性的科学运用:2021-2024年数据显示,中证全债与沪深300相关系数达-0.899,黄金与美股相关系数仅0.603,这种低相关性在2025年7月美股暴跌时体现出明显对冲效果,含10%黄金ETF的配置方案回撤仅0.36%[2]。同时,全球化市场配置进一步降低了单一区域风险,验证了A股、港股、美股及债券、商品搭配的有效性[1][2][3][4][5]。

雪球三分法组合策略通过三重分散框架和低相关性资产配置,在不同市场周期下表现出较强的抗回撤能力和稳健收益;A股、港股、美股及债券、商品的搭配能有效实现全球化资产配置。投资者在使用该策略时需严格执行规则,并结合自身风险承受能力灵活调整。

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.