Economic Confidence Plummets to 3-Year Low Amid Government Shutdown Concerns

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

This analysis is based on the Forbes report [1] published on November 7, 2025, which reported that consumer confidence in the U.S. economy has fallen to a three-year low amid growing concerns about the government shutdown.

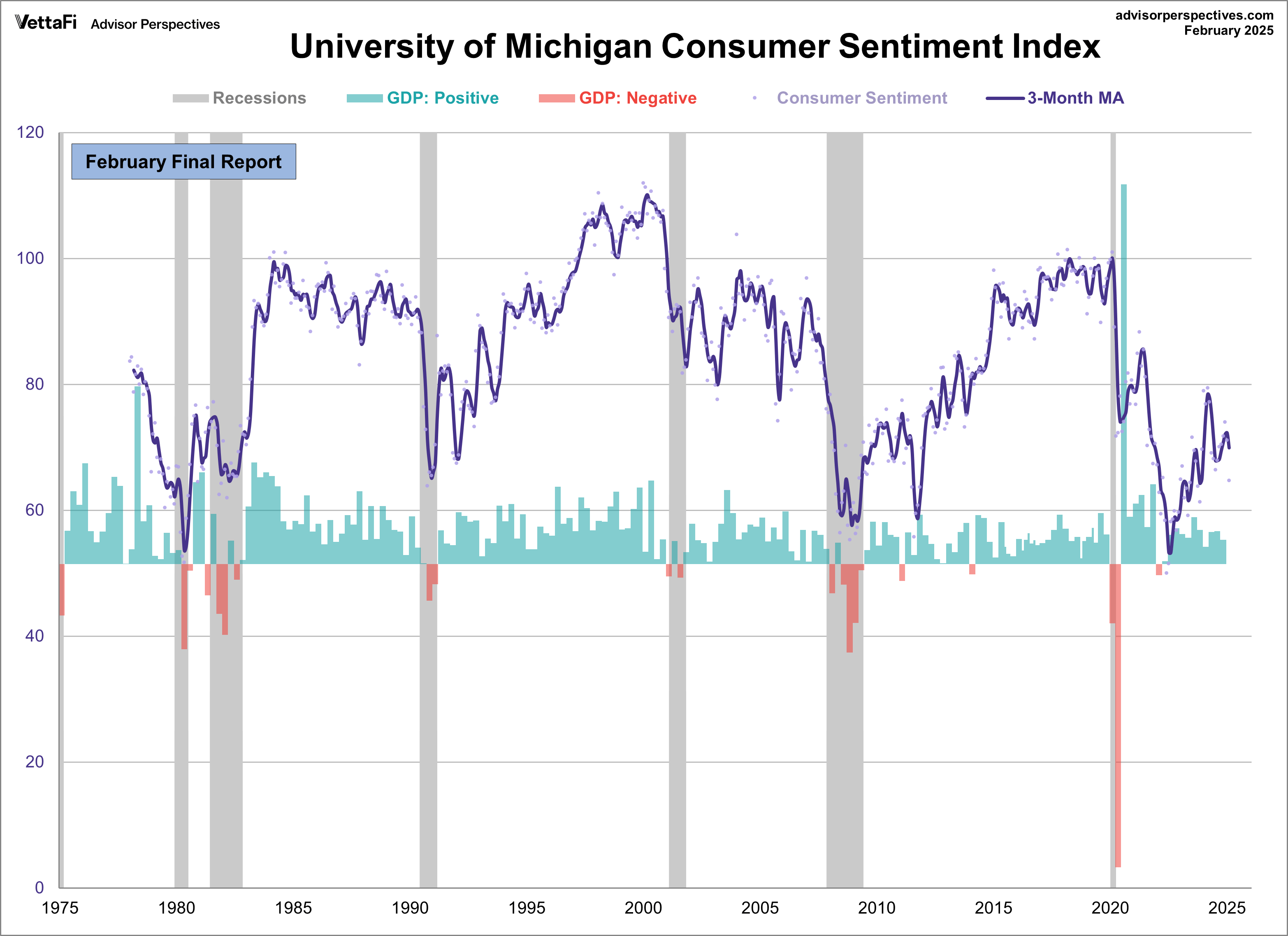

The University of Michigan Survey of Consumers revealed a significant decline in economic confidence, with the sentiment index plunging to 50.3 in November 2025, down from 53.6 in October [1]. This represents the lowest level of consumer confidence since June 2022 and marks a nearly 30% decline year-over-year [1][2]. The primary driver appears to be the ongoing federal government shutdown, now the longest in U.S. history at over 36 days [1].

The economic impact is already being reflected in financial markets, with major indices showing weakness on November 7 - the S&P 500 down 0.77% and Nasdaq down 1.22% [0]. This market reaction suggests investors are pricing in the potential economic consequences of prolonged government closure and deteriorating consumer sentiment.

- Consumer Spending Contraction: Historical data suggests that sentiment levels below 50 typically precede reduced consumer spending, which could severely impact the upcoming holiday retail season [1][2]

- Employment Market Deterioration: Rising job loss expectations could become self-fulfilling if businesses respond to reduced consumer demand by cutting positions [1]

- Federal Contractor Exposure: Unlike federal employees, many contractors are not guaranteed back pay, creating broader economic ripple effects that could extend beyond the direct government workforce [3]

- Policy Response Tracking: Federal Reserve and government responses to declining confidence could provide early signals of economic stabilization measures

- Sector-Specific Impacts: Retail and discretionary spending sectors may present opportunities for analysis of consumer behavior changes

- Regional Economic Variations: Areas with high concentrations of federal workers may experience disproportionate economic impacts, creating localized investment considerations

The University of Michigan Survey of Consumers data [1] indicates that consumer sentiment has reached a critical threshold at 50.3, with the government shutdown serving as the primary catalyst for this decline. The survey reveals that approximately 1.4 million federal workers are directly affected by the shutdown [3], with potential wage losses of $21 billion if the impasse continues through December. Market reactions [0] suggest investors are already pricing in economic risks, while employment expectations have reached their highest level of concern since March 2025 [1]. The combination of deteriorating consumer confidence, government workforce disruption, and market weakness signals potential broader economic challenges that warrant close monitoring in the coming weeks.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.