Market Pressure Analysis: Consumer Sentiment Decline and Government Data Blackout Impact

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

This analysis is based on the Schwab Network report by Kevin Green [1] published on November 7, 2025, which highlighted ongoing market downside pressure as trading week concluded, with particular emphasis on deteriorating consumer sentiment amid a significant economic data blackout due to the ongoing government shutdown.

The S&P 500 closed at 6,653.64, down 42.54 points (-0.64%), confirming Green’s observation about the index testing critical 50-day SMA support [0][1]. This represents approximately a 2.9% decline from the November 5 peak of 6,796.29, indicating significant short-term technical pressure [0]. The broader market decline was led by technology stocks, with NASDAQ Composite falling 1.09% to 22,643.61, while Dow Jones showed relative resilience with a 0.27% decline to 46,669.22 [0].

The compression in consumer sentiment noted by Green is substantiated by multiple data points. University of Michigan’s final consumer sentiment index for October 2025 fell to 53.6, down from 55.1 in September, representing a 24% year-over-year decline from October 2024’s 70.5 [2]. This deterioration is further confirmed by the RealClearMarkets/TIPP Economic Optimism Index plummeting to 43.9 in November 2025, marking the third consecutive month below the critical 50-point benchmark and signaling widespread pessimism not seen since June 2024 [3].

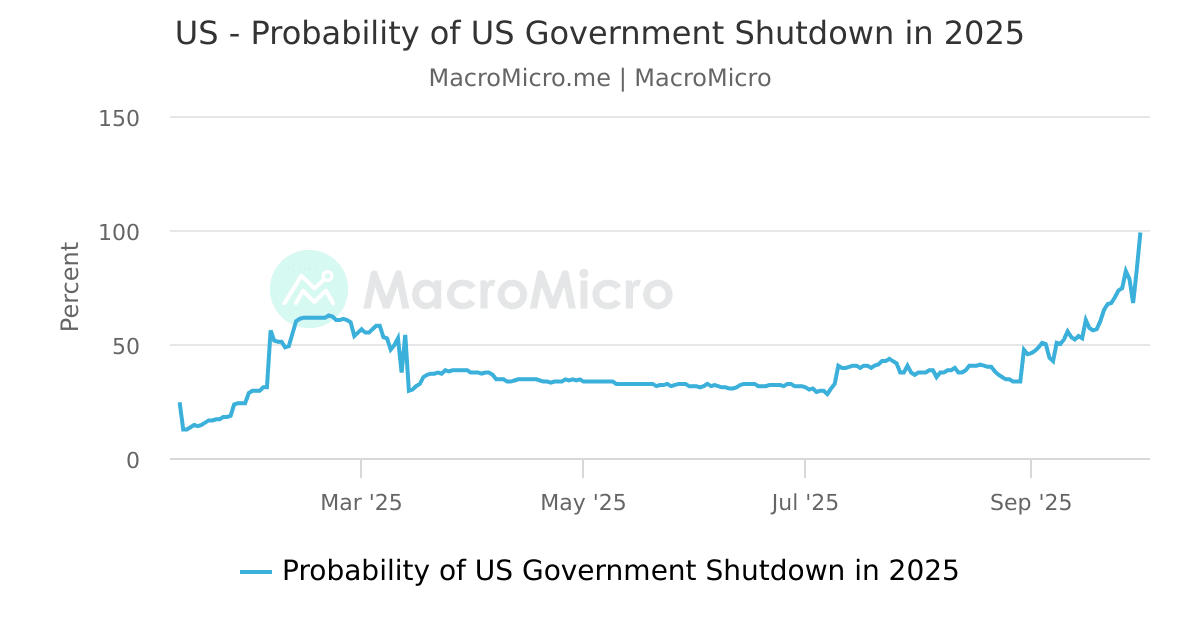

The ongoing government shutdown has created the longest data blackout since 2018-2019, occurring at a critical economic juncture [4]. This information vacuum has suspended federal economic data releases including CPI, retail sales, and jobless claims, forcing markets to rely heavily on Federal Reserve communications and private-sector proxies [4][5]. The CBO estimates between $7-14 billion in permanently lost economic output, with Goldman Sachs projecting Q4 GDP growth of just 1% [5].

The current market environment reveals several interconnected risk factors. Elevated volatility (VIX exceeding 20) correlates with deteriorating consumer confidence, creating a feedback loop where weak sentiment drives market selling, which in turn further erodes confidence [1][0]. The technology sector’s significant underperformance (-1.45%) suggests growth-oriented stocks are particularly vulnerable to this sentiment-driven sell-off [0].

Notably, while US markets faced pressure, Chinese markets showed resilience with Shanghai Composite gaining 1.08% for the week [0]. This divergence suggests different economic fundamentals or policy responses, highlighting the importance of global diversification in current market conditions.

The mixed commodity performance reflects conflicting economic signals. Energy weakness (crude oil heading for second consecutive weekly decline in $59-63 range) contrasts with natural gas strength, while precious metals show relative stability with gold at $4,003 per ounce [6][7]. This mixed picture may indicate sector-specific factors rather than broad economic trends.

-

Technical Breakdown Risk: The S&P 500’s proximity to 50-day SMA support creates vulnerability; a sustained break below could trigger additional institutional selling and momentum-driven declines [0][1].

-

Consumer Spending Contraction: Deteriorating sentiment indices (53.6 level) suggest potential retail spending weakness, particularly in discretionary categories, which could impact Q4 earnings [2][3].

-

Extended Shutdown Impact: Prolonged government shutdown could permanently reduce Q4 GDP by 1-2% according to CBO projections, creating structural economic damage [5].

-

Basic Materials Outperformance: The sector showed relative strength (+1.12%), potentially indicating defensive positioning or specific commodity tailwinds [0].

-

Volatility Trading Opportunities: Elevated VIX levels above 20 create opportunities for volatility-based strategies and risk management products [1].

-

Information Advantage: Market participants with access to alternative data sources may gain temporary advantages during the government data blackout [4].

- S&P 500: 6,653.64 (-0.64%, testing 50-day SMA) [0]

- NASDAQ: 22,643.61 (-1.09%) [0]

- Dow Jones: 46,669.22 (-0.27%) [0]

- VIX: Above 20 (elevated volatility) [1]

- University of Michigan Sentiment: 53.6 (October final, down from 55.1) [2]

- TIPP Economic Optimism: 43.9 (November, below 50-point benchmark) [3]

- Monthly employment reports and unemployment claims [4]

- CPI and PCE inflation metrics [4]

- Retail sales and consumer spending data [4]

- Manufacturing PMI and industrial production [4]

- Technology: -1.45% (leading decliner) [0]

- Basic Materials: +1.12% (outperformer) [0]

- Energy: +0.19% [0]

The combination of technical vulnerability, fundamental weakness in consumer sentiment, and unprecedented information uncertainty creates a challenging market environment requiring careful risk management and monitoring of key technical levels, particularly the S&P 500’s 50-day SMA support [0][1][2][4].

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.