Bitcoin $143K 2026 Forecast: ETF-Driven Adoption Analysis

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

On December 19, 2025, a MarketWatch report [1] published a Wall Street forecast predicting Bitcoin (BTC) will rally to $143,000 by the end of 2026, driven primarily by increased institutional and retail adoption via exchange-traded funds (ETFs). At the time of the announcement, Bitcoin was trading around $88,000 [2], implying a required ~62% price increase to reach the forecasted target.

Crypto-related stocks showed mixed but mostly positive short-term performance on the announcement day: Coinbase (COIN) closed up 0.22% [0], MicroStrategy (MSTR), a notable Bitcoin treasury holder, rose 0.87% [0], and Riot Platforms (RIOT), a Bitcoin miner, saw a 5.61% gain [0]. However, the forecast’s bullish tone was somewhat tempered by broader market concerns, including BlackRock’s IBIT ETF recording its first monthly outflows in November 2025 ($2.3 billion) [2]. Competing institutional forecasts further contextualize the $143k target: Standard Chartered and Bernstein project $150k by 2026 [3], while JPMorgan forecasts $170k by mid-2026 [4], indicating a broad consensus on significant Bitcoin upside with varying target levels.

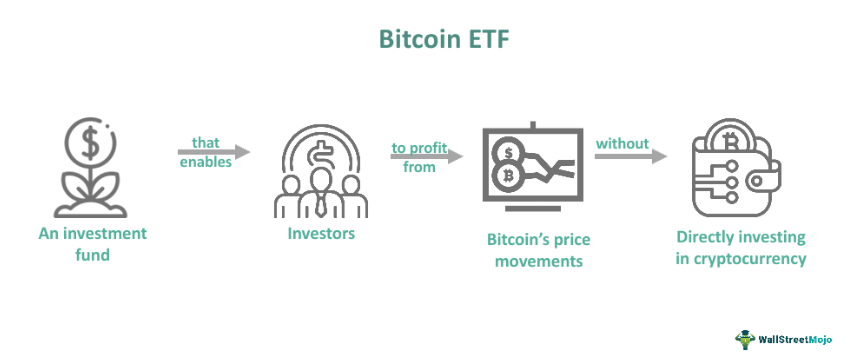

- ETF Adoption as a Unifying Bullish Driver: The $143k forecast, alongside competing institutional predictions, reinforces the central role of ETFs in shaping Bitcoin’s medium-term demand outlook. This narrative suggests institutions continue to view ETFs as a primary onramp for Bitcoin exposure, despite recent outflow data [2][3][4].

- Mixed Short-Term Reactions Reflect Investor Caution: The modest gains in crypto stocks (COIN, MSTR) and more pronounced rise in RIOT highlight divergent investor reactions. Miners may have benefited from the bullish price forecast’s implication of higher Bitcoin values, while broader crypto service providers faced headwinds from recent ETF outflow concerns [0][2].

- Consensus with Target Variability: The range of bullish forecasts ($143k–$170k) from Wall Street firms indicates a shared belief in Bitcoin’s upside but underscores uncertainty around the exact magnitude, likely due to differing assumptions about ETF adoption rates and macroeconomic conditions.

- ETF Inflow Volatility: If ETF inflows slow or remain negative (as seen with IBIT in November 2025), the forecast’s core assumption of growing adoption could be undermined [2].

- Regulatory Uncertainty: Proposed rules, such as MSCI considering excluding companies with >50% digital asset holdings from indexes, could reduce institutional demand [2].

- Historical Volatility: Bitcoin has historically experienced monthly price swings of 20% or more [5], meaning short-term drawdowns remain likely even if the medium-term bullish trend holds.

- Sustained ETF Adoption: If the forecast’s assumption of increasing ETF inflows materializes, it could drive significant institutional capital into Bitcoin, supporting the path to $143k [1].

- Broader Institutional Consensus: The alignment of major firms on Bitcoin’s upside may strengthen investor confidence and attract new participants to the market [3][4].

This analysis centers on a December 19, 2025, MarketWatch report [1] of a Wall Street forecast projecting Bitcoin to reach $143,000 by 2026, driven by ETF adoption. Bitcoin’s current price (~$88k) [2] requires a ~62% increase to meet this target. Crypto stocks showed mixed positive performance on the announcement day [0], with miner Riot Platforms (RIOT) outperforming Coinbase (COIN) and MicroStrategy (MSTR). The forecast is set against a backdrop of recent ETF outflows [2] and competing institutional forecasts ranging from $150k to $170k [3][4]. Key considerations include ETF flow volatility, regulatory risks, and Bitcoin’s historical price swings.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.