Hongxing Development (600367) Limit-Up Analysis and Market Dynamics

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

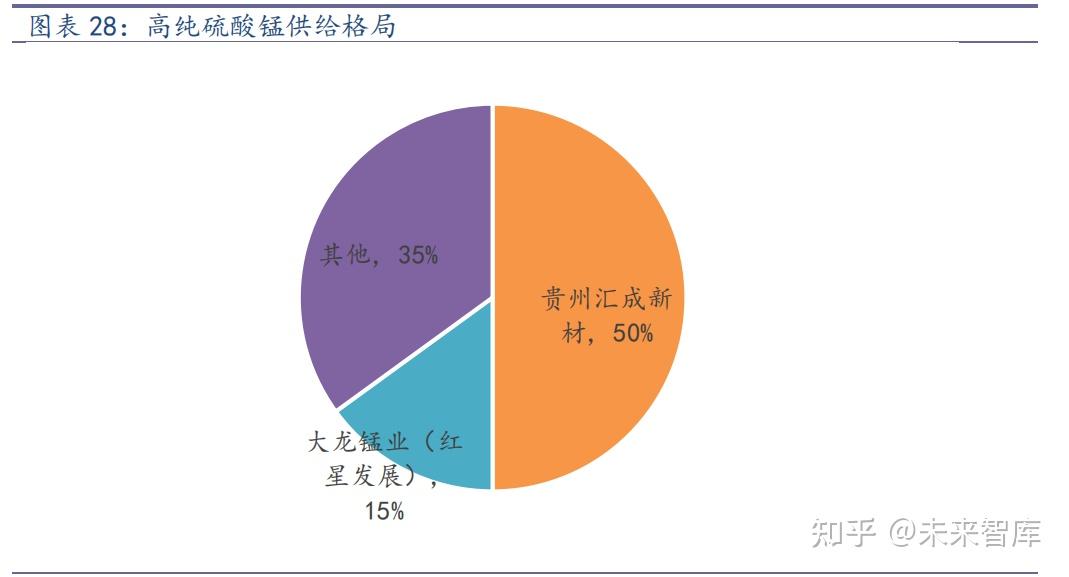

Hongxing Development (600367) hit the limit-up on December 19, 2025, with the core driving factor being market speculation on the solid-state battery concept [1][2]. The company confirmed on the interactive platform that some downstream solid-state battery enterprises have purchased its manganese-based products (including high-purity manganese sulfate with an annual capacity of 30,000 tons, a key raw material for solid-state battery cathode materials) for performance verification [1]. During the same period, the solid-state battery sector as a whole strengthened, further amplifying the market’s expectations for the company’s supply chain position and pushing the stock price to the limit [2].

In terms of price and trading volume, the trading volume on December 19 reached 27.31M shares, significantly higher than the average level in the previous period, indicating a large inflow of funds [0]. As of December 24, the 5-day cumulative increase was 9.79%, and the year-to-date increase was 58.43%. Technically, the recent support level is about $17.28 and the resistance level is $18.39 [0].

This limit-up reflects the valuation pull effect of new energy material concepts (solid-state batteries) on cyclical chemical stocks. As a leading manganese material company, Hongxing Development successfully combined traditional business with a high-boom track by extending to the solid-state battery field, attracting market capital attention. At the same time, the main funds had a 5-day net inflow of 156 million yuan, with high institutional participation, reflecting professional investors’ recognition of its potential value [3]. However, it should be noted that the current P/E ratio of 44.87x is higher than the industry average, and the valuation has already reflected some expectations in advance [0].

Hongxing Development’s limit-up was catalyzed by the solid-state battery concept, and the market’s attention was raised by the application expectations of the company’s manganese-based products in the new energy field. Although the stock price has performed strongly in the short term, it should be viewed cautiously in combination with the valuation level and business progress. Investors should pay attention to the verification results of the company’s solid-state battery business, the overall trend of the sector, and changes in capital flows.

Reference Sources:

[0] Jinling Analysis Database

[1] Cailianshe - Hongxing Development: Some solid-state battery enterprises purchase the company’s manganese-based products for verification

[2] Eastmoney Stock Bar - Hongxing Development Discussion Community

[3] Sina Finance - Hongxing Development hits limit-up, turnover 461 million yuan, 5-day main fund net inflow 156 million yuan

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.