Analysis of the Reasons for the Limit-Up and Market Impact of Guotai Group (603977)

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

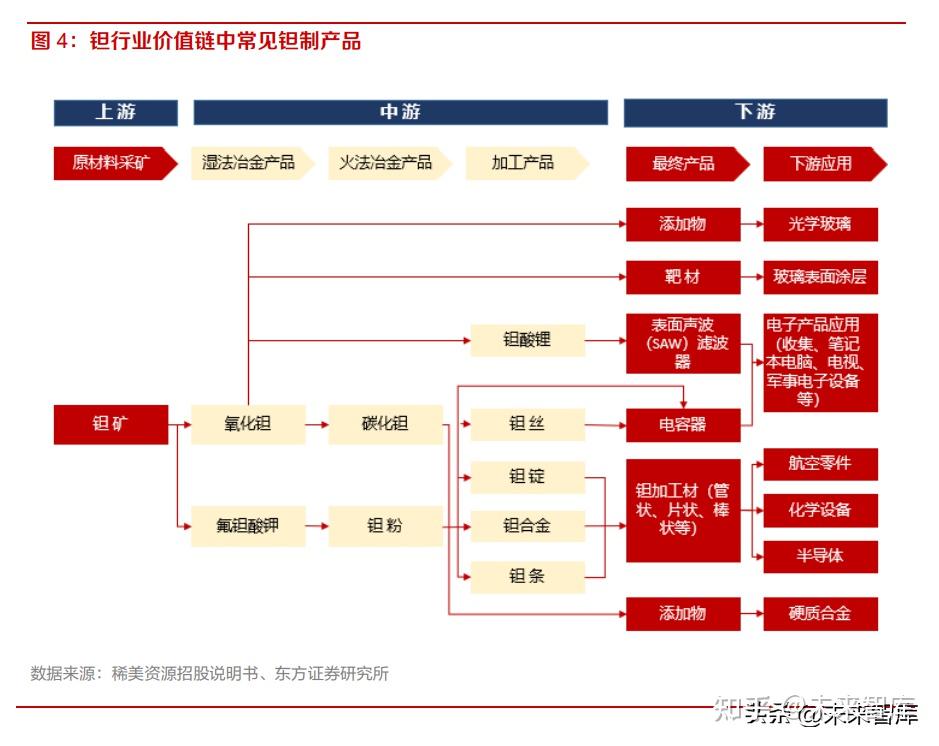

Guotai Group (603977) hit the 10% limit-up on December 19, 2025, mainly catalyzed by the collective outbreak of the controlled nuclear fusion concept sector [1]. On that day, the market spread news of a $6 billion nuclear fusion cooperation, driving the concept sector to strengthen [2]. As a core enterprise in the tantalum-niobium material field, Guotai Group’s products are key upstream materials for nuclear fusion technology [1], so it directly benefited from this industry positive.

From the data, the closing price on December 18, 2025 was 12.92 yuan, and the closing price on December 19 reached 14.21 yuan, achieving a 10% limit-up [0]. The trading volume on that day was 62.21 million shares, far higher than the 30-day average trading volume of 15.97 million shares [0], showing strong market capital attention and buying interest.

The controlled nuclear fusion concept sector performed strongly overall on December 19 [2]. As a core target in the sector, Guotai Group’s limit-up reflects the market’s optimistic sentiment towards the development prospects of nuclear fusion technology. High trading volume also indicates high investor participation, and short-term market sentiment is positive.

- Obvious concept-driven characteristics: This limit-up was mainly driven by industry concept positives, not major changes in the company’s own fundamentals, so the market trend has short-term speculation characteristics.

- Sector linkage effect: From the performance of peer stocks in the same sector such as Wangzi New Material, the market influence of the nuclear fusion concept is strong, and the sector linkage effect is obvious [2].

- Valuation risk needs attention: The company’s current price-earnings ratio is 60.04 times, which is at a relatively high level, and attention needs to be paid to the correction risk brought by overvaluation [0].

- Short-term nature of concept speculation: This limit-up is driven by industry concepts, lacking long-term fundamental support, and market sentiment may reverse quickly.

- High valuation risk: The price-earnings ratio of 60.04 times is already at a high level. If the concept heat fades, the stock price may face correction pressure [0].

- Market volatility risk: Concept stocks are usually more volatile, and investors need to pay attention to short-term price volatility risks.

- Industry development prospects: As an important direction of future energy, if nuclear fusion technology breaks through or industrialization is implemented, the company is expected to benefit in the long term.

- Sector linkage opportunities: If the nuclear fusion concept continues to ferment, the company as a core target may continue to receive market attention.

Guotai Group (603977) hit the limit-up on December 19, 2025, mainly driven by the positive news of the controlled nuclear fusion concept. As a core enterprise of tantalum-niobium materials, the company directly benefited from the $6 billion nuclear fusion cooperation news on that day. Trading volume increased significantly, and market sentiment was optimistic, but attention should be paid to the risks of high valuation and short-term nature of concept speculation. The subsequent trend needs to closely monitor the sustainability of the nuclear fusion concept, changes in the company’s fundamentals, and the overall market sentiment.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.