Analysis of the Impact Mechanism of Huati Technology's Clarification Announcement on Stock Price Volatility and Market Sentiment

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Huati Technology (603679.SS) saw its stock price hit consecutive limit-ups on December 18 and 19, 2025, driven by commercial aerospace concept speculation [0]. On December 19, 2025, the company issued a clarification announcement, clearly stating that it is not involved in commercial aerospace business; its core businesses are new smart city scenarios and cultural lighting, and it reminded investors to invest rationally [1]. The clarification announcement directly negated the core logic of the speculation, leading to a large number of sell-offs by investors who entered due to concept speculation. On the first trading day after clarification (December 22), the stock price dropped sharply from the limit-up price ($21.24) to $17.39, a decline of 18.13% [0]. The trading volume on that day was 60.60 million shares, 8 times the average volume (7.32 million shares), reflecting the sharp reversal of market sentiment and concentrated release of selling pressure [0]. Subsequently, the stock price continued to fluctuate downward, closing at $15.41 on December 24, gradually returning to the reasonable valuation range before the clarification [0].

- Disconnect Between Concept Speculation and Fundamentals: Huati Technology’s consecutive limit-ups lacked core business support and were purely driven by market concept speculation; the release of the clarification announcement quickly broke this valuation bubble that was disconnected from fundamentals.

- Immediate Sentiment Impact of Official Clarification: As an official statement from a listed company, the clarification announcement had a particularly significant impact on retail investors, who are often the main participants in concept speculation; their concentrated sell-offs led to large stock price fluctuations.

- Signal Significance of Volume Expansion: The surge in trading volume on the first trading day after clarification is an important indicator of market sentiment reversal, reflecting investors’ rapid increase in awareness of concept speculation risks.

- Inevitability of Stock Price Regression: Without fundamental support, speculation-driven stock price increases are unsustainable; the clarification announcement accelerated the process of stock prices returning to reasonable valuations.

- Risks: Sharp stock price fluctuations caused by concept speculation may lead to short-term losses for investors; blind following of hot concepts in the market may cover up the company’s true fundamentals; if listed companies fail to issue clarification announcements in a timely manner, they may face greater market volatility and regulatory risks.

- Opportunities: The stock price correction after concept speculation provides investors with an opportunity to evaluate its true value based on the company’s core businesses (new smart city scenarios, cultural lighting); the timely clarification by the listed company helps maintain market information transparency and investor confidence.

- Event Timeline: Commercial aerospace concept speculation → consecutive two limit-ups → company issues clarification announcement → stock price plummets → gradually returns to reasonable valuation.

- Core Data: Consecutive limit-ups on December 18-19, 2025; 18.13% stock price drop and 8x volume expansion on December 22; closing price of $15.41 on December 24, close to pre-clarification valuation.

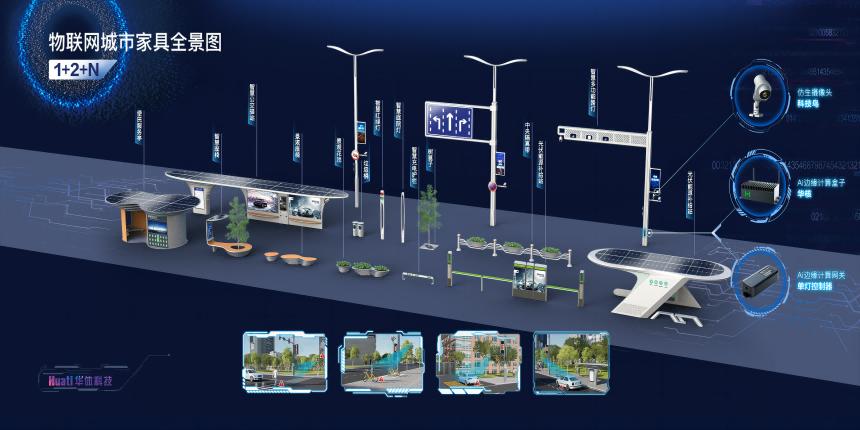

- Company Business: Huati Technology’s core businesses are new smart city scenarios and cultural lighting, and it is not involved in commercial aerospace business [1].

- Investment Tips: Investors should focus on the listed company’s core businesses and financial fundamentals, be alert to the volatility of concept speculation, and avoid blind following.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.