PR市赚率在A股红利指数投资中的有效性与适用性分析

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

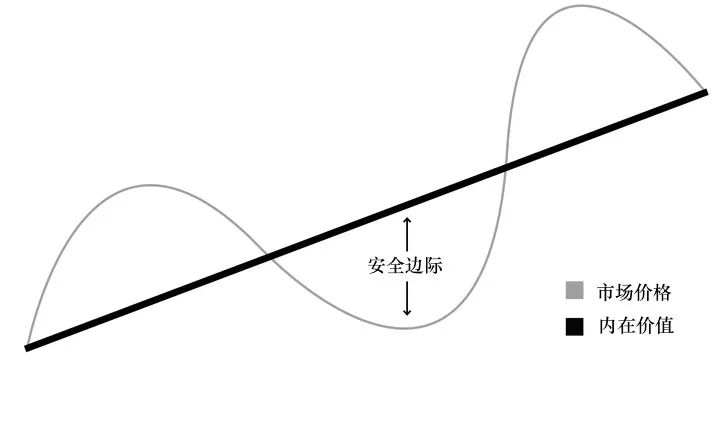

PR市赚率由雪球用户提出,核心逻辑源于巴菲特"四毛钱买一元钱东西"的安全边际理念[1]。其公式PR=PE/ROE(ROE取百分号前数值)将估值(PE)与盈利能力(ROE)结合,PR<1视为低估,PR=1为合理估值,PR>1为高估[1]。

针对A股红利指数,华泰证券研究显示红利因子中期有效,中证红利指数年化总回报约13%[3]。PR市赚率对红利指数的潜在适用性体现在:红利指数成分股盈利稳定、ROE较高,PR能更全面衡量估值水平;2018年赢家财富网回测显示PR对中证红利指数未来一年收益率有较好预测能力[5]。当前三只指数PR值(0.71-0.81)均低于1,处于低估区间。

PR市赚率本质是安全边际理论的量化延伸:当PR<1时,PE低于ROE,意味着投资者为每单位盈利能力支付的价格低于盈利水平本身,符合"四毛钱买一元钱东西"的逻辑[2]。但需注意其局限性:未考虑成长率(g),对成长型红利股可能估值偏差;周期股需用多年平均ROE,否则会因ROE波动失真[2]。

PR市赚率结合估值与盈利能力,对盈利稳定的红利指数具有一定适用性,符合巴菲特安全边际理念。但需注意其局限性,当前指数PR值需进一步验证,投资时需结合其他指标和市场环境综合判断。

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.