骨科集采影响下行业龙头的增长策略分析

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

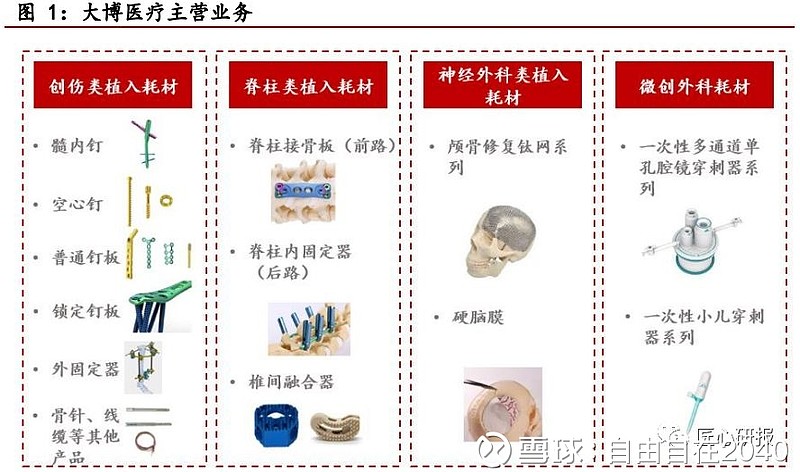

骨科集采政策重塑了国内骨科医疗器械行业格局,头部企业通过品类拓展和海外扩张寻求增长动力。根据分析数据,大博医疗2025年股价涨幅达64.24%[0],市场对其转型策略给予积极反馈。财务层面,大博医疗净利润率为21.82%,ROE达16.99%,展现了较好的盈利能力和运营效率[0]。

行业龙头企业的转型策略呈现两大方向:一是品类扩展,通过丰富产品线降低集采单一品类依赖;二是海外扩张,开拓国际市场缓解国内政策压力。这些策略不仅支撑了企业收入增长,也提升了市场信心,推动股价表现。

骨科集采政策驱动行业龙头企业加速转型,品类扩展和海外扩张是主要策略。大博医疗等企业的股价和财务表现反映了转型的初步成效,市场对其长期增长潜力持认可态度。

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.