Stock Market Pullback Analysis: Tech Correction vs. Layoff Concerns

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

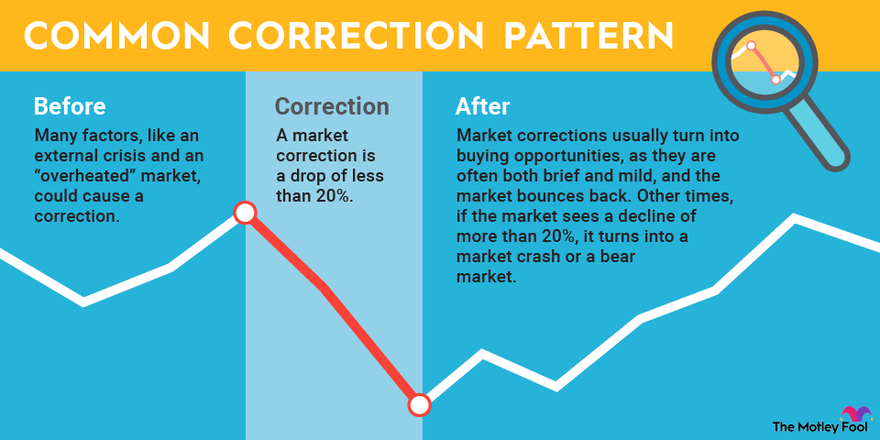

This analysis is based on the Seeking Alpha report [1] published on November 7, 2025, which characterizes the current market pullback as a “healthy correction” primarily affecting overvalued speculative tech and AI-related stocks. The article argues that layoff headlines are overstated and not a significant threat to consumer spending or economic growth [1].

However, comprehensive market data and labor statistics reveal a more complex picture. The S&P 500 declined 0.48% to 6,664.15 on November 7, following a 0.99% drop the previous day, while the NASDAQ Composite showed more severe weakness with a 0.71% decline to 22,731.26 after a 1.74% fall on November 6 [0]. Technology and growth sectors bore the brunt of the decline, with the technology sector down 1.58%, Consumer Cyclical down 2.13%, and Industrials down 2.28% [0].

Contrary to the article’s dismissal of layoff concerns, Challenger, Gray & Christmas reported 153,074 job cuts announced in October 2025 - representing a 183% increase from September and 175% increase from October 2024, marking the highest October total since 2003 [2]. The technology sector was hardest hit with 33,281 cuts, nearly six times September’s level [3].

- Labor Market Acceleration: The combination of government shutdown disrupting official jobs data and private sector reports showing historic layoff levels creates uncertainty about true employment conditions [2]

- AI Valuation Correction: High P/E ratios in AI stocks suggest potential for significant downside if growth expectations are not met or if AI integration costs prove higher than anticipated

- Consumer Spending Vulnerability: While the article dismisses layoff impacts on spending [1], the scale of job cuts could eventually affect consumer confidence and discretionary spending

- Weekly jobless claims data to track actual unemployment trends versus announced cuts

- AI company earnings to assess whether current valuations are justified by fundamentals

- Consumer spending metrics to validate resilience claims

- Federal Reserve policy signals regarding interest rate changes amid economic uncertainty

The market appears to be experiencing both a necessary valuation correction in speculative tech names and legitimate concerns about economic restructuring due to AI adoption. The technology sector’s outperformance in job cuts (33,281 in October) [3] suggests this is not merely a market phenomenon but reflects real industry transformation.

The current market decline reflects a complex interplay of valuation correction and economic restructuring. While the Seeking Alpha article [1] accurately identifies overvaluation in speculative tech and AI names, it significantly understates the labor market impact of 153,074 October job cuts [2]. The technology sector’s dual role - as both the most overvalued market segment and the hardest hit by layoffs - creates a feedback loop that could extend the correction beyond simple valuation normalization.

Market data shows the NASDAQ Composite declining 0.71% [0] with individual AI stocks showing significant weakness, while broader economic indicators suggest the correction may be signaling deeper structural changes in the economy driven by AI integration and cost optimization pressures. The divergence between the article’s optimistic assessment and the underlying labor market data warrants careful monitoring of consumer spending trends and corporate earnings in the coming quarters.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.