Dongxing Securities (601198) Limit-up Analysis: CICC Merger Catalyst and Future Outlook

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

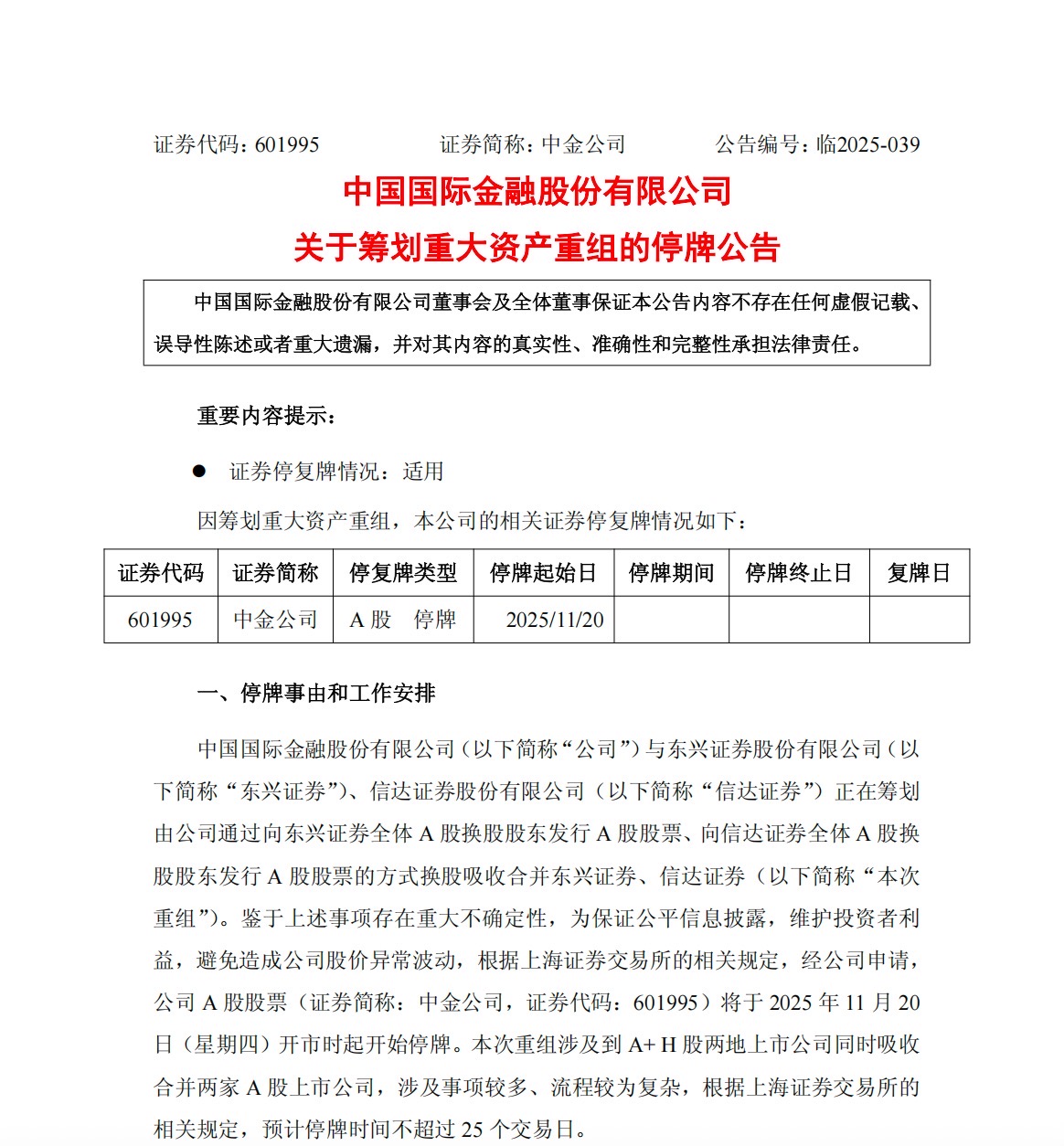

Dongxing Securities’ limit-up today was directly catalyzed by CICC’s announcement of absorption and merger on the evening of December 17, 2025 [1][2][3][4][5]. The announcement shows that CICC plans to merge Dongxing Securities and Cinda Securities via share exchange, and the three brokerages resumed trading on December 18. Investors generally believe that the merger will enhance Dongxing Securities’ industry position and resource integration capabilities, so it opened with a 10% limit-up.

According to Jinling Analysis Database [0], Dongxing Securities closed at $14.44 today, up 9.98% from the previous trading day’s $13.13, hitting a 52-week high. The daily trading volume was 12.82M, lower than the average of 34.96M—this is because the limit-up was sealed instantly at the opening, leading to scarce selling orders, reflecting investors’ strong bullish sentiment towards the merger news.

- Individual stock sentiment: Investors are optimistic about Dongxing Securities’ merger prospects; the limit-up order reflects positive market expectations

- Sector sentiment: The brokerage sector showed differentiation, with CICC rising over 5% and Cinda Securities rising 4.83%, but the Brokerage ETF Fund (515010) fell 1.14% [1][2][3], indicating divergence in the market’s overall reaction to the merger news

- Long-term Impact of Merger Event: If the merger is completed smoothly, Dongxing Securities will benefit from CICC’s brand influence and resource advantages, and its long-term competitiveness is expected to improve

- Short-term Liquidity Pressure: A limit-up with low volume means that if profit-taking demand arises later, it may trigger sharp stock price fluctuations

- Logic of Sector Differentiation: The decline in the Brokerage ETF reflects market concerns that the merger may lead to changes in the industry competition pattern, negatively affecting some brokerages

- Merger Uncertainty: The merger is in the planning stage, requiring regulatory approval and shareholder voting; there is a risk of plan changes or failure [1][4][5]

- Valuation Correction Risk: The stock price has hit a 52-week high; if merger progress is not as expected or market sentiment cools, a correction may occur

- Liquidity Risk: Today’s low trading volume amplifies the impact of subsequent selling pressure

If the merger plan progresses smoothly and obtains regulatory approval, Dongxing Securities’ long-term value is expected to further increase; investors can pay attention to investment opportunities brought by merger progress

- Dongxing Securities (601198) had a limit-up on December 18, 2025, closing at $14.44, a 52-week high

- Core reason for limit-up: CICC announced absorption and merger of Dongxing Securities and Cinda Securities

- Market sentiment: Optimistic for the individual stock but divided in the sector

- Subsequent focus: Merger progress, regulatory approval, changes in trading volume, and performance of support level ($13.13) and resistance level (current 52-week high of $14.44)

This report is based on public market data and news reports, providing objective analysis and does not constitute investment advice.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.