Impact Assessment of Space Solar Power Station (SSPS) Industrialization on Investment Value of Zhenlei Technology and Qianzhao Optoelectronics

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

- Current Valuation: Market capitalization of 248.1 billion USD, P/E ratio of 237.53x, P/B ratio of 11.14x

- Profitability: Net profit margin of 24.65%, ROE of 4.78%, high gross profit margin level [0]

- Stock Price Performance: Year-to-date increase of 242.90%, outstanding performance but high valuation with relatively high risk

- Core Business: RF front-end chips, RF transceiver chips, high-speed high-precision ADC/DAC chips, power management chips, and microsystem modules [1]

- Technical Advantages: Has deep accumulation in satellite communication chip field, is a core supplier of RF, power, and ADC/DAC chips in domestic satellite communication field [1]

- Current Valuation: Market capitalization of 223.6 billion USD, P/E ratio of 166.94x, P/B ratio of 5.33x

- Profitability: Net profit margin of 4.09%, ROE of 3.23%, relatively weak profitability [0]

- Stock Price Performance: Year-to-date increase of 145.02%, valuation is also high but relatively more attractive

- Core Business: Gallium arsenide solar cell epitaxial wafers and chips, LED chips [1]

- Technical Advantages: Gallium arsenide solar cell epitaxial wafers and chips have been mass-applied in commercial aerospace field, shipments have ranked first in domestic market consistently [1]

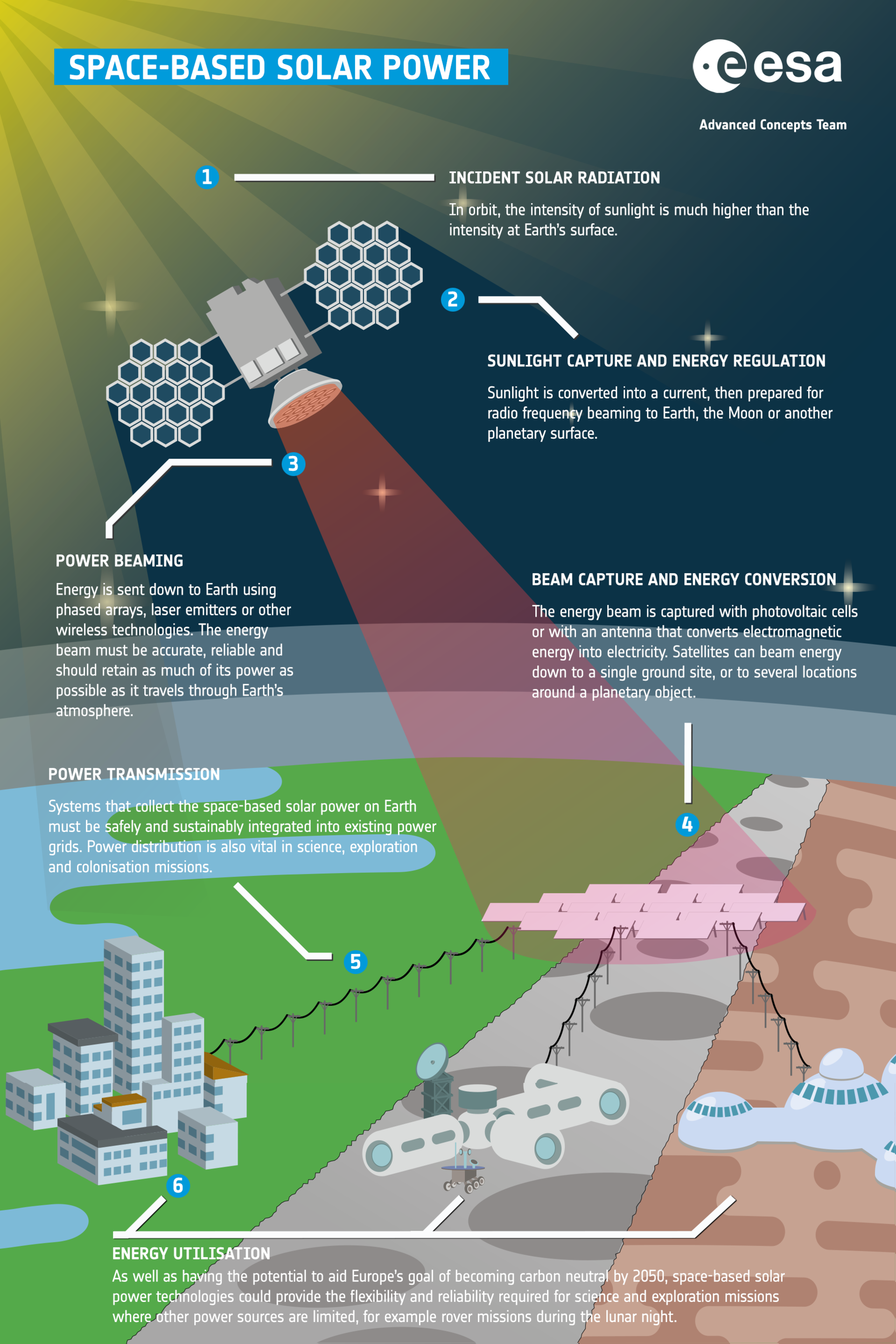

- Space Segment: Space environment-adaptive components

- Energy Conversion: High-efficiency solar cell arrays

- Energy Transmission: Microwave/laser wireless transmission

- Ground Reception: Energy reception and conversion

- System Integration: Overall solutions

- Advantage Fields: Microwave wireless energy transmission, RF signal processing, high-precision ADC/DAC conversion

- Technical Matching Degree: Has significant advantages in energy transmission and system integration links (5/5 points)

- Market Position: Core supplier of RF chips in domestic satellite communication field, products fully cover commercial low-orbit satellite demands [1]

- SSPS Application: Provides core RF components and signal processing chips for microwave wireless energy transmission

- Advantage Fields: Gallium arsenide solar cells, high-efficiency photovoltaic conversion

- Technical Matching Degree: Has core advantages in energy conversion link (5/5 points)

- Market Position: Gallium arsenide solar cell shipments rank first in domestic market, have been applied in multiple satellites [1]

- SSPS Application: Provides high-efficiency gallium arsenide cell wafers and epitaxial materials for space solar cell arrays

- Zhenlei Technology: RF chip technology has extremely high barriers, has first-mover advantage in domestic satellite communication field [1]

- Qianzhao Optoelectronics: Gallium arsenide solar cell process is mature, but faces competition pressure from silicon-based cells in photovoltaic field

- SSPS Market: Expected to reach GW-level scale by 2050, with trillion-level market space

- Zhenlei Technology: Benefits from multiple concepts such as satellite internet and 6G communication, has broad growth space

- Qianzhao Optoelectronics: Directly benefits from demand growth of SSPS energy conversion, but needs to pay attention to competition in traditional photovoltaic business

Both companies have been rated as “low risk” in financial risk [0], but Zhenlei Technology has negative cash flow (-189 million CNY), while Qianzhao Optoelectronics has positive cash flow (291 million CNY) [0]

Current valuations are both high: Zhenlei Technology has a PE of 237x, Qianzhao Optoelectronics has a PE of 167x, which need high future performance growth to digest

- Pay Attention to Policy Catalysts: Closely follow the progress of SSPS projects such as the “Sun-Chasing Project”

- Valuation Risk Control: Valuations of both stocks are at high levels, need to control positions

- Prefer Qianzhao Optoelectronics: Relatively more attractive valuation and more core position in SSPS industry chain

- Technical Breakthrough Nodes: Pay attention to the time window of key technical breakthroughs of SSPS

- Industry Chain Integration: The two companies are expected to form synergies in SSPS industry chain

- Performance Realization Period: Expected to enter a period of rapid performance growth starting from the medium term

- Trillion-level Market Space: SSPS industrialization will bring huge market opportunities

- Technical Leading Advantage: Companies with core technologies will enjoy valuation premiums

- International Opportunities: Participate in global SSPS project construction and standard formulation

- Technical Risk: SSPS technology is not fully mature, with uncertainty in technical routes

- Policy Risk: Adjustments in national strategies may affect project progress speed

- Valuation Risk: Current valuation is too high, with callback risk

- Competition Risk: Domestic and foreign competitors may enter related fields

- Commercialization Risk: SSPS commercialization process may be slower than expected

- Advantages: High technical barriers, irreplaceable position in RF transmission link

- Risks: Too high valuation, negative cash flow

- Recommendation: Strategic allocation in medium and long term, need to control positions cautiously in short term

- Advantages: Occupies core position in SSPS energy conversion link, relatively reasonable valuation

- Risks: Weak profitability, faces competition in traditional photovoltaic business

- Recommendation: Focus on in medium term, has high certainty of benefiting from SSPS industrialization

The industrialization process of space solar power stations will bring long-term growth opportunities for these two companies, but need to be alert to valuation risks in the short term. Investors are advised to allocate these two stocks reasonably according to their own risk preferences and investment horizons.

[0] Gilin API Data - Company financial data and stock price information

[1] Sina Finance - “14th Five-Year Plan Emphasizes High, SpaceX to IPO, Domestic Rockets Launch Continuously! Commercial Aerospace is Booming Unstoppably” (https://finance.sina.com.cn/roll/2025-12-12/doc-inhapwfa6933666.shtml)

[2] Dabanke - “Qianzhao Optoelectronics (300102.SZ) - Analysis of Price Limit Reasons | Analysis of Stock-related Concepts” (https://dabanke.com/gupiao-300102.html)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.