Tesla Valuation Reconstruction: From Automotive Manufacturing to AI + Autonomous Driving Assets

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

- Current Pricing Deviates from Fundamentals:Tesla’s market cap of $1.50 trillion and PE ratio exceeding 245x reflect that the market has fully discounted future growth into the price [0]. However, based on the DCF model from Jinling AI Brokerage API, the reasonable value range under conservative/benchmark/optimistic scenarios is only between $141 and $188, far below the current price, indicating a huge mismatch between short-term expectations and AI growth expectations in the market [0]. This forces a shift in valuation logic from a “unit delivery + gross profit” model to a composite model of “AI leverage + network value”.

- Reassessment of Growth Trajectory/Risk-Reward:The DCF assumes a compound annual revenue growth rate of over 30%, but the WACC is as high as 17.5%, reflecting that uncertainties such as autonomous driving have led to a significant increase in capital costs. The only support for the high valuation is the imagination of future free cash flow expanding from “vehicle control + services” to “robot software licensing + FSD subscriptions + energy + Optimus” [0].

- Short-Term Feedback from Technicals and Capital Flows:In the daily charts for 2024-2025, the stock price has remained above the 20/50/200-day moving averages, and the RSI has approached the overbought zone multiple times, indicating an increasing risk of short-term correction, but upward momentum is still supported by the AI narrative [0].

Figure 1: TSLA closing prices and 20/50/200-day moving averages, RSI (X-axis: Date, Y-axis: USD; RSI = Relative Strength Index) for 2024-2025. Data source: Jinling AI Brokerage API [0].

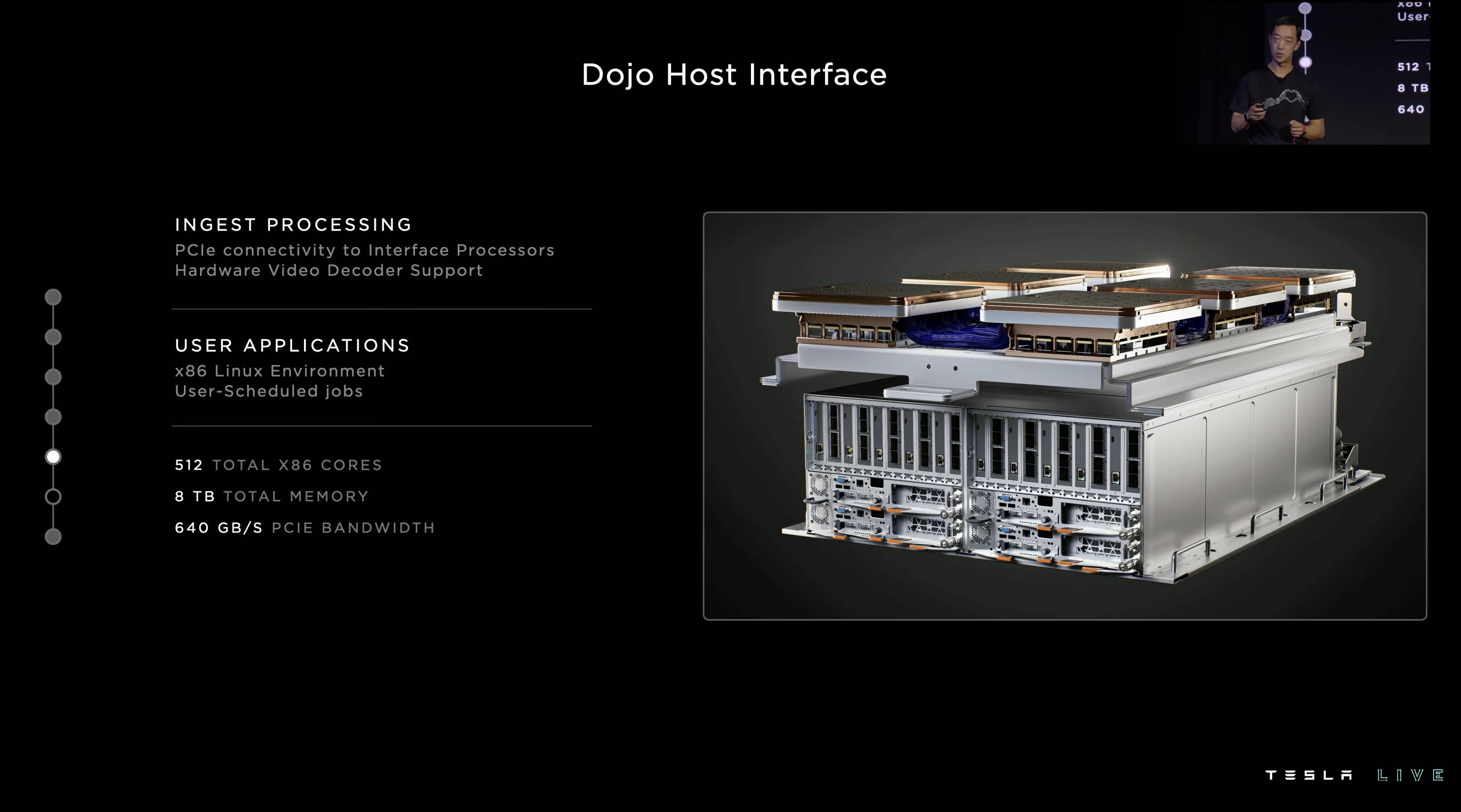

- Scale Advantages of FSD + Dojo:Tens of millions of Tesla vehicles collect high-frequency driving data on roads daily, combined with the training capabilities of Dojo supercomputers, allowing the FSD model to form a closed loop in “real samples + iteration” that competitors find hard to replicate (as market observations note, starting in 2025, investors have focused more on FSD and Optimus progress rather than mere delivery data) [4]. This system transforms automotive hardware into “physical AI endpoints”, with corresponding profit sources shifting from one-time sales to high-margin software licensing and robot services.

- Imagination of Expanding to “Physical AI”:Tesla is migrating autonomous driving technology to scenarios such as Optimus robots and Starlink in-vehicle terminals. If deployment can be achieved in high-wage industries facing labor shortages, it means that the structural revenue per vehicle will be completely different from traditional automotive businesses, becoming a new dimension to evaluate its capital efficiency [3].

- Short-Term Regulatory and Reputational Risks:California regulators have threatened to suspend sales due to FSD promotions, requiring changes to the “Autopilot” wording or proof of substantial Level 4 capabilities; if Tesla is forced to adjust its strategy without meeting these requirements, it will reduce the “trust premium” for autonomous driving [1]. Additionally, European regulators have a cautious attitude towards FSD approval, indicating that global deployment still needs to align with local compliance, affecting the pace of potential robotaxi/subscription revenue [2].

- Industry Competitive Landscape:Tesla, through the “vehicle-data-supercomputer-robot” closed loop, is lightweighting the assets of automakers (with software + AI accounting for an increasing proportion), posing a “strategic homogenization” threat to traditional car manufacturers. If Tesla realizes Robotaxi and Optimus automation, traditional manufacturers will find it difficult to catch up without equivalent data and computing power investments, and competitive advantages will shift from “manufacturing supply chains” to “AI training capabilities + ecosystem operations”.

- Capital Allocation Logic:For investors, they must evaluate both “automotive baseline cash flow + future AI business segments”. It is recommended to adopt layered allocation: conservative investors can perform cash flow discounting around FSD subscription cash flow and energy business to pursue a margin of safety; aggressive investors need to focus on monitoring FSD unlocking/Optimus profit verification nodes, relevant regulatory changes, and the impact of AI data center expenditures on capital expenditures and cash conversion.

- Contrarian Investment and Market Mismatch:The fact that the current market cap is extremely disconnected from DCF suggests that if Tesla can truly scale FSD subscriptions in the next one to two fiscal years, the market will see “narrative returns”; otherwise, the price will revert to fundamentals. It is recommended to maintain dynamic positions before FSD or Optimus milestones are confirmed, use market volatility to make “contrarian position additions”, while remaining vigilant about regulatory and AI data center policies (such as reviews of Dojo expansion or AI data center construction) [1][2].

- Valuation Reassessment:The current price needs to be re-evaluated using a cash flow model comprising “AI platform + autonomous driving subscriptions + robots/energy”. DCF indicates significant downside risks; vigilance is needed for pullbacks if the narrative fails to meet expectations.

- Investment Strategy:Enter in batches using regulatory/technical nodes; continuously monitor FSD certification progress, Dojo computing capacity expansion, and Optimus commercialization path. For risk-averse investors, wait for initial profit signals from AI businesses before determining diversified allocations.

- Industry Reshaping:Tesla’s transformation is pushing the entire traditional automotive industry to restructure product definitions and capital expenditure priorities. Future leaders will be companies that can achieve scale effects in the “data + algorithms + vehicles” trinity.

For more in-depth scenario simulations, robot business modeling, or horizontal comparisons with traditional automakers, consider enabling deep research mode to access more accurate brokerage databases and industry research chart support.

[0] Jinling AI Brokerage API Data (including TSLA company overview, DCF valuation, technical analysis charts, financial analysis reports)

[1] Benzinga - “Tesla Faces License Suspension In California Over FSD Claims As Gerber Says ‘The Days Are Over,’ Munster Calls Ruling ‘Absurd’” (https://www.benzinga.com/markets/tech/25/12/49469169/tesla-faces-license-suspension-in-california-over-fsd-claims-as-gerber-says-the-days-are-over-munste)

[2] Bloomberg - “Tesla’s EU Regulator Denies Carmaker’s Claim FSD to Be Approved” (https://www.bloomberg.com/news/articles/2025-11-24/tesla-s-eu-regulator-denies-that-it-s-agreed-to-approve-fsd)

[3] Forbes - “Will Optimus And Physical AI Transform Tesla?” (https://www.forbes.com/sites/greatspeculations/2025/11/18/will-optimus-and-physical-ai-transform-tesla/)

[4] Yahoo Finance - “Tesla’s 2025 Was a Turning Point. Here Are 3 Things Investors …” (https://finance.yahoo.com/news/teslas-2025-turning-point-3-102500492.html?fr=sycsrp_catchall)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.