Analysis of Shunhao Co., Ltd.'s Commercial Aerospace Business Layout and Investment Value

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

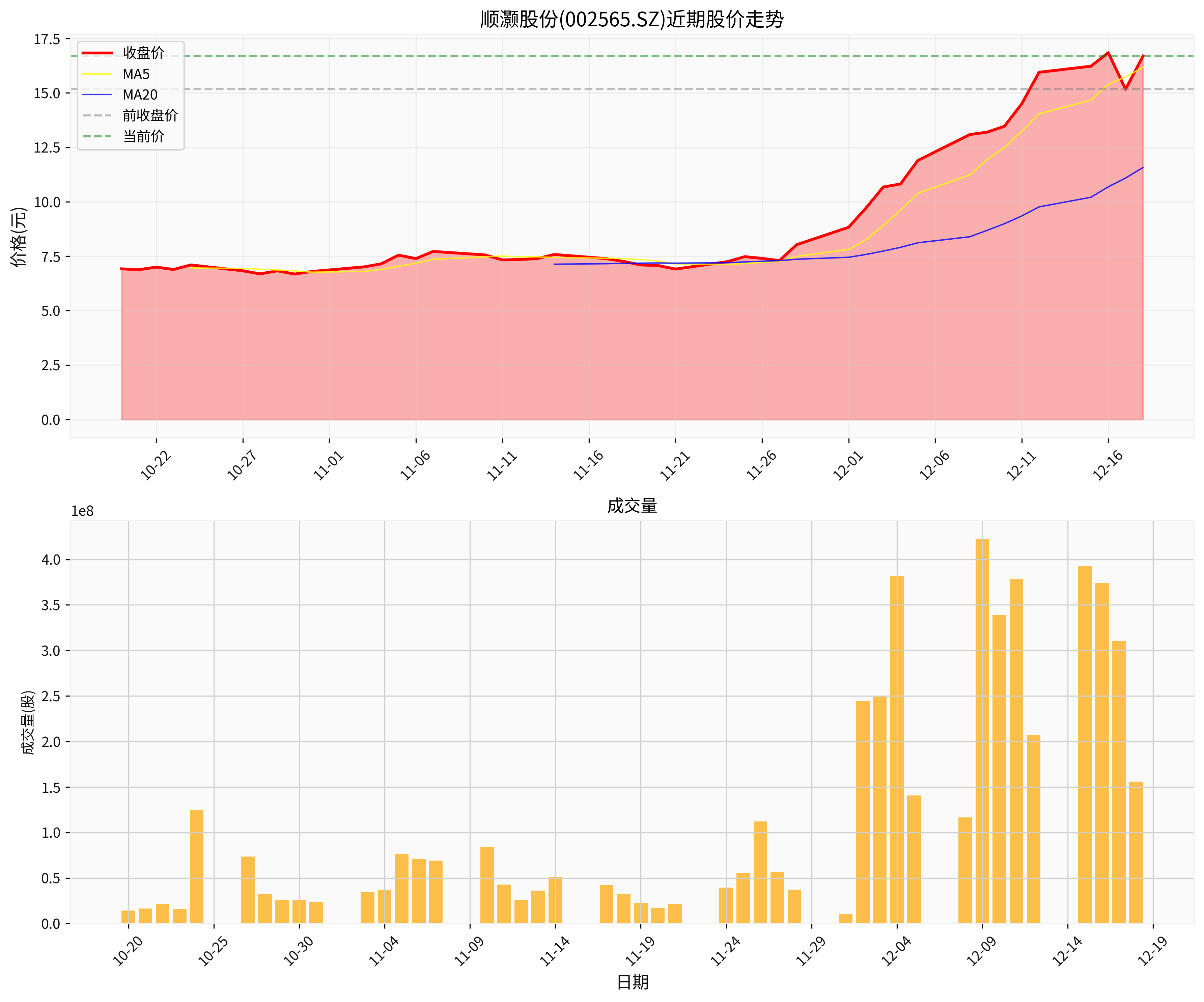

Shunhao Co., Ltd. (002565.SZ) is a high-tech enterprise headquartered in Shanghai, listed on the Shenzhen Stock Exchange on March 18, 2011, with a registered capital of 1.06 billion yuan [0]. Recently, the stock has performed extremely actively in the A-share market. According to technical analysis data, over the past 60 trading days, the stock price has risen from 7.25 yuan to 16.69 yuan, an increase of 130.21% [0], with 8 approximate daily limit-ups during this period [0].

Shunhao Co., Ltd. originally mainly engaged in

The company entered the commercial aerospace sector through strategic investments:

- Investment in Orbital Chenguang: The company strategically invested in Beijing Orbital Chenguang Technology Co., Ltd., which focuses on space computing power-related businesses [2]

- Computing Power Satellite Project: Participated in the computing power satellite project named Starcloud-1, whose successful launch confirmed the feasibility of space computing power moving from concept to implementation [2]

- Cooperation with Technology Research Institute: Established a cooperative relationship with Beijing Xingchen Future Space Technology Research Institute [2]

Shunhao Co., Ltd. is classified by the market as a “

- Valuation Level: Currently, the P/E ratio is as high as 333.80 times and the P/B ratio is 9.37 times [0], indicating an extremely high valuation level

- Profitability: ROE is only 3.04% and net profit margin is 4.41% [0], showing relatively weak profitability

- Financial Status: Current ratio is 3.26 and quick ratio is 2.68, with good short-term solvency [0]

- Financial Health: Financial analysis shows that the company has a relatively aggressive financial attitude, and its debt risk is classified as low [0]

- Track Prospects: Space computing power is an emerging concept that meets the huge demand for computing power in the AI era

- Policy Support: National policy orientation to vigorously develop commercial aerospace and new-quality productivity

- First-mover Advantage: Has a forward-looking layout in the niche track of space computing power

- Excessively High Valuation: The current P/E ratio of 333 times is far beyond the reasonable level, with significant bubbles

- Business Transformation: Transitioning from traditional manufacturing to high-tech fields, with high execution risks

- Concept Speculation: Mainly driven by concepts, lacking actual performance support

From a global perspective, commercial aerospace indeed has long-term development potential:

- SpaceX Valuation: Has reached $800 billion, planning an IPO in 2026 [3][4]

- Technology Trend: Space data centers have become a new direction for AI computing power expansion, with giants like Google and SpaceX laying out their plans [4]

- National Strategy: Commercial aerospace is listed as a national strategic emerging industry

- Policy Support: Relevant support policies are continuously introduced, providing a good environment for industry development

- Clear industry trend, huge market space for commercial aerospace

- Continuous growth in AI computing power demand, space computing power has real application scenarios

- Strong policy support, institutional guarantee for industry development

- Current concept speculation in A-shares is too intense, with obvious valuation bubbles

- Technology maturity and commercial implementation still need time to verify

- Changes in regulatory policies may affect market sentiment

Shunhao Co., Ltd. has seen a huge increase recently, with a seriously high valuation,

As a strategic emerging industry, commercial aerospace does have long-term investment value, but it requires:

- Selecting enterprises with real core technical strength

- Paying attention to the progress of commercial implementation and performance fulfillment

- Waiting for the valuation to return to a reasonable range before considering layout

- Market Risk: Concept stocks have extremely high volatility; investment needs to be cautious

- Technology Risk: Technologies like space computing are still in the early stages

- Regulatory Risk: Policy changes may affect industry development

Shunhao Co., Ltd.'s layout in the commercial aerospace sector reflects the company’s strategic vision for emerging industries, but the current stock price increase and valuation level have far exceeded the support of fundamentals. The activity of commercial aerospace concept stocks has

[0] Gilin API Data

[1] Xueqiu - “6 Daily Limit-Ups in 7 Days! Shunhao Co., Ltd. (002565): Space Computing Power + 3,000 Stores” (https://xueqiu.com/2328995877/366397943)

[2] Shunhao Co., Ltd. Official Website - Company Industry Layout and News Updates (http://shunhostock.com/)

[3] The Wall Street Journal - “SpaceX Valuation Expected to Surpass OpenAI” (https://cn.wsj.com/articles/spacex-in-talks-for-share-sale-that-would-boost-valuation-to-800-billion-bbd2f227)

[4] Bloomberg - “SpaceX Sets $800 Billion Valuation, Confirms 2026 IPO Plans” (https://www.bloomberg.com/news/articles/2025-12-13/spacex-sets-insider-share-deal-at-about-800-billion-valuation)

[5] The Wall Street Journal - “The Race to Bring Data Centers to Space” (https://www.wsj.com/tech/ai/the-race-to-bring-data-centers-to-space-9c9fb494)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.