Market Concentration Risk Analysis: AI Sentiment Fatigue and Quality Stock Opportunities

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

This analysis is based on the CNBC Television interview [1] with Matt Powers, Managing Partner at Powers Advisory Group, published on November 7, 2025, where he identified concentration risk as the biggest market threat and highlighted AI sentiment fatigue while favoring quality dividend-paying stocks.

Current market conditions substantiate Powers’ warnings about concentration risk. Major indices experienced significant declines on November 6, with the S&P 500 falling 0.99% to 6,720.32, NASDAQ dropping 1.74% to 23,053.99, and the Dow Jones declining 0.73% to 46,912.31 [0]. The technology sector was particularly weak, declining 1.58%, while Healthcare showed resilience with a 0.45% gain [0].

The concentration risk Powers identifies is empirically validated by market structure data. The top 10 S&P 500 companies now account for approximately 39-42% of the index’s total market capitalization, significantly exceeding the 27% peak during the 1999-2000 tech bubble [2]. NVIDIA exemplifies this concentration, maintaining a $4.58 trillion market cap while trading at $188.08 (-3.65% on November 7) [0].

Powers’ observation of AI sentiment fatigue is supported by multiple data points. A Bank of America survey revealed that 54% of institutional investors believe AI stocks are in a bubble [2]. The tech-heavy NASDAQ’s recent underperformance relative to broader indices suggests a rotation away from AI-heavy positions [0]. This sentiment shift appears to be driving the market volatility observed in recent sessions.

Valuation concerns specifically related to AI stocks have been cited as catalysts for broad market sell-offs [2]. NVIDIA’s elevated P/E ratio of 53.58x [0] compared to broader market averages suggests potential for mean reversion, particularly as institutional sentiment becomes increasingly cautious.

Powers’ recommendation of quality dividend-paying names like Merck & Co. demonstrates strong analytical merit. Merck’s financial fundamentals provide a compelling contrast to AI sector valuations:

- Current Performance: Trading at $85.78 (+1.65% on November 7) with strong analyst consensus (95% rating, 65.7% Buy recommendations) [0]

- Valuation Metrics: P/E ratio of 11.35x, significantly below tech sector averages, with a price target of $95.00 representing 10.7% upside potential [0]

- Financial Strength: 29.63% net profit margin and 38.95% ROE, coupled with consistent dividend payments [0]

Merck’s resilience during market stress, outperforming while tech declined, validates Powers’ quality-focused approach [0].

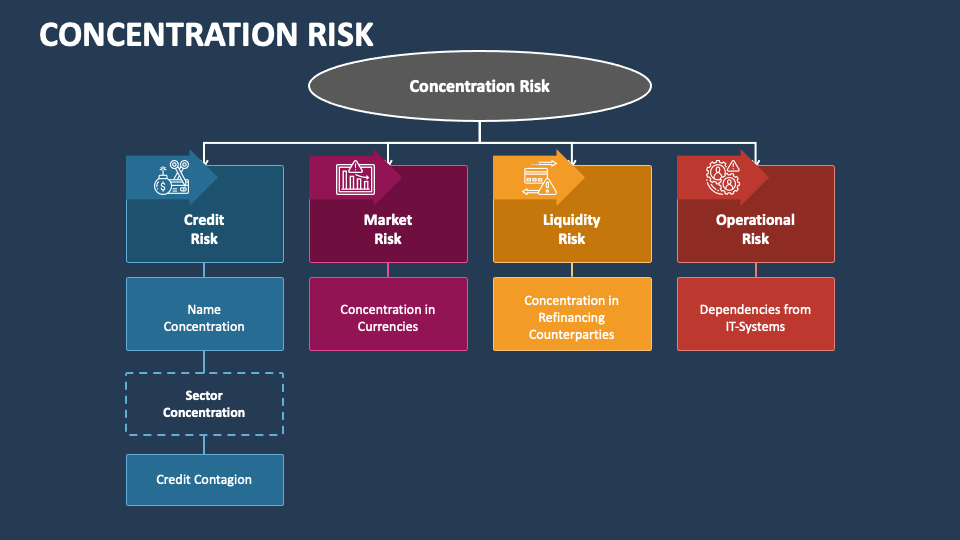

The extreme market concentration creates systemic vulnerability beyond individual stock risk. When 39-42% of market capitalization is concentrated in just 10 companies [2], any correction in these holdings could trigger cascading effects throughout the market. This concentration represents a structural risk factor that differs from typical market volatility.

The emerging pattern suggests a significant sector rotation from growth-oriented AI stocks to value-oriented quality names. This rotation is driven by both valuation concerns and sentiment fatigue, creating potential opportunities in defensive sectors like Healthcare, which demonstrated resilience during recent market stress [0].

Current concentration levels exceed those observed during previous market peaks, including the 1999-2000 tech bubble [2]. Historical analysis suggests that when concentration reaches extreme levels and sentiment becomes overly optimistic in a single sector, corrections tend to be severe and prolonged. Powers’ warning carries significant weight given this historical context.

- Concentration Risk Amplification: The 60-year high in market concentration creates systemic vulnerability that could trigger broader market corrections [2]

- AI Valuation Correction: High P/E ratios across AI stocks suggest potential for mean reversion, particularly as institutional sentiment turns negative [0, 2]

- Sentiment Reversal Acceleration: With 54% of institutional investors viewing AI stocks as bubbly [2], sentiment shifts could trigger rapid outflows

- Quality Defensive Positioning: Stocks like Merck offer attractive valuations, dividend yields, and resilience during market stress [0]

- Sector Rotation Benefits: Healthcare and other defensive sectors may continue to outperform as capital rotates from overvalued growth stocks

- Market Breadth Improvement: As concentration decreases, broader market participation could create opportunities across mid-cap and small-cap segments

Market analysis validates Matt Powers’ concerns about concentration risk as the primary market threat. Current data shows top 10 S&P 500 holdings at 39-42% concentration, exceeding 1999-2000 tech bubble levels [2]. AI sentiment fatigue is evidenced by 54% of institutional investors viewing the sector as overvalued [2], while recent market performance shows tech underperforming (-1.58%) compared to Healthcare resilience (+0.45%) [0].

Quality dividend-paying stocks like Merck demonstrate compelling alternatives, with strong fundamentals (P/E 11.35x, 29.63% net margin) and analyst consensus supporting upside potential [0]. The market structure suggests ongoing sector rotation from AI growth stocks to quality value names, creating opportunities for defensive positioning while managing concentration risk exposure.

Decision-makers should monitor market breadth indicators, AI valuation corrections, and institutional flow patterns as key leading indicators for potential market dynamics shifts. The extreme concentration levels warrant careful risk management and portfolio diversification strategies.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.