Strategic Analysis: Timing Index Fund Entry in an Elevated Market Environment

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

The S&P 500 is currently trading at

The market is experiencing elevated valuations that warrant caution:

- S&P 500 P/E ratiohas climbed to approximately23x[1]

- Shiller CAPE ratio(cyclically-adjusted P/E) is also at elevated levels [1]

- The recent AI-driven rally has shown some cracks as investors question sustainability [1]

However, more than half of S&P 500 stocks now have lower P/E ratios than they did as of September 30, suggesting the market may be undergoing a healthy rotation rather than a uniform overvaluation [1].

Historical analysis shows that timing the market consistently is extremely difficult. Since 2024, the S&P 500 has delivered a

The current market environment presents several risk factors:

- Maximum drawdown over the past year: 18.90%[0]

- Elevated volatility at 12.1%[0]

- Concerns about AI bubble sustainability and high valuations [1]

Holding cash in money market funds yielding 3.8-4.0% creates substantial opportunity cost:

- 5-year opportunity cost vs. moderate market returns (8%): $26,433 on $100,000

- That’s a 21.9% differenceover a 5-year horizon [0]

Research consistently shows that

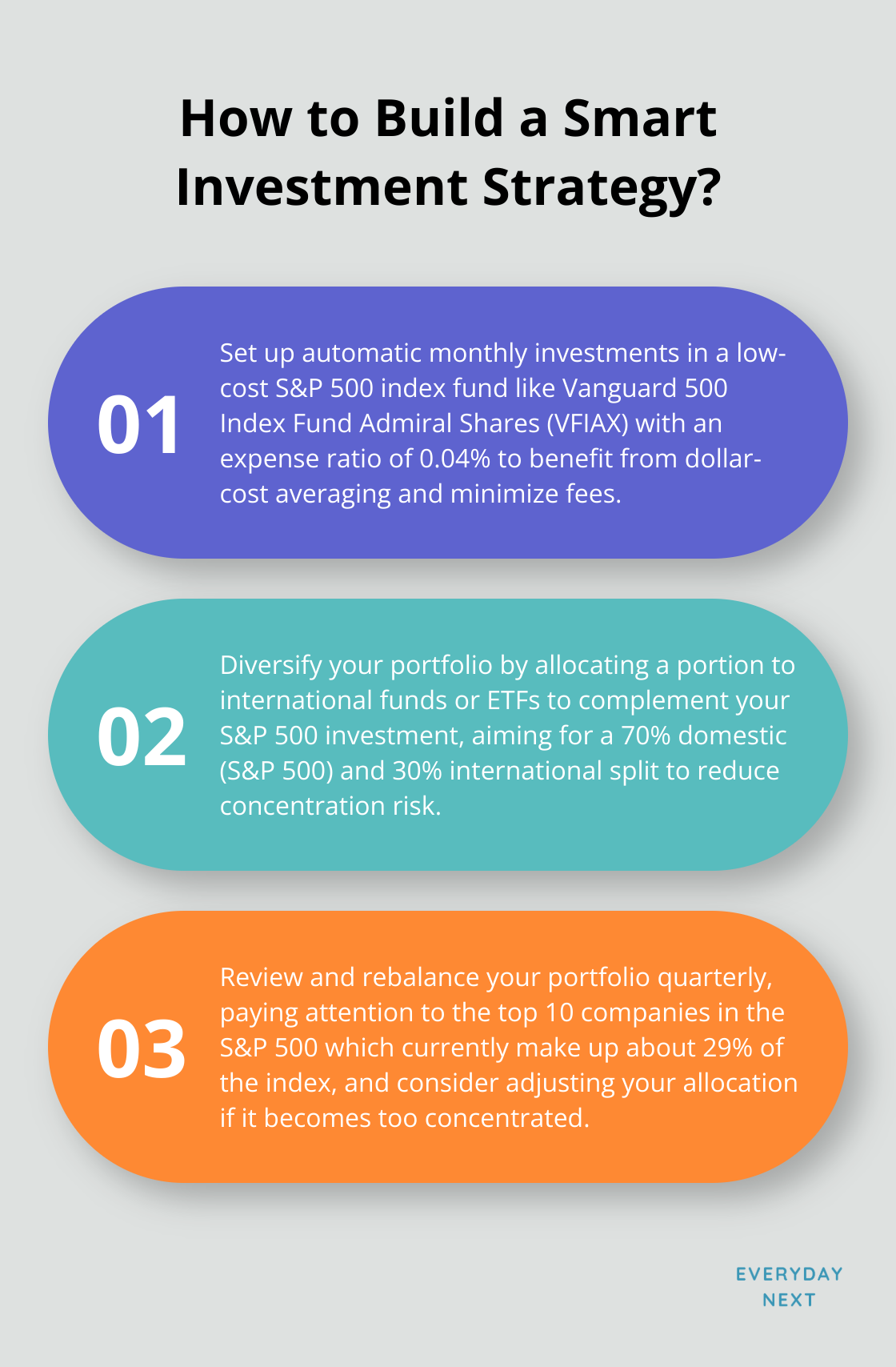

- Reduces volatility exposure through consistent, disciplined investing

- Eliminates the emotional component of timing decisions

- Allows participation in market growth while mitigating downside risk

- Particularly valuable in uncertain, elevated market environments

For those concerned about near-term corrections but wanting to avoid missing gains:

- Initial entry (40-50%): Invest a significant portion now to establish position

- Systematic additions (30-40%): Monthly investments over 6-12 months

- Opportunistic buys (10-20%): Deploy remaining capital if market corrects 8-10%+

Given current market dynamics, consider:

- Value vs. Growth tilt: Many growth stocks have become cheaper recently [1]

- Sector diversification: Avoid concentration in any single hot sector

- Quality focus: Focus on companies with strong fundamentals regardless of valuation

Based on current market conditions:

- Continued upside probability: Moderate (market near highs, but earnings season could provide catalyst)

- Correction probability: Moderate to high (elevated valuations, seasonal factors)

- Severe bear market probability: Low (economic fundamentals remain solid)

- You have long time horizon (5+ years)

- Can tolerate 15-20% drawdowns

- Value long-term compounding over short-term timing

- Medium time horizon (3-5 years)

- Moderate risk tolerance

- Want balance between opportunity cost and risk management

- Shorter time horizon (<3 years)

- Low risk tolerance

- Significant concern about market valuations

- Begin DCA program immediately: Don’t wait for the “perfect” entry point

- Establish core position: 40-50% of target allocation in quality index funds

- Set trigger points: Pre-determine levels for additional investments

- Maintain cash buffer: Keep 10-15% for opportunities and psychological comfort

- Stop-loss consideration: Consider protective stops at 15-20% below entry points

- Rebalancing schedule: Quarterly or semi-annual portfolio reviews

- Alternative assets: Consider modest allocations to bonds, REITs, or international equity

Key indicators to watch:

- Valuation metrics: P/E, CAPE ratios trending back toward historical averages

- Market breadth: Advance/decline lines, new highs vs. new lows

- Interest rate environment: Fed policy impacts on equity valuations

- Earnings momentum: Corporate earnings growth vs. expectations

While current market valuations are elevated, the opportunity cost of remaining in cash is substantial. Historical evidence strongly favors

The key is to

[0] Ginlix AI Market Data - S&P 500 pricing and performance analysis

[1] Yahoo Finance - “Bubble Trouble: AI rally shows cracks as investors question…” (December 2025)

[2] Yahoo Finance - “50 Habits That Will Prepare You for a Comfortable Retirement” - Dollar-cost averaging and timing the market research

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.