Analysis of Long-Term Investment Value Differences Between Pop Mart and Disney's IP Models

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Based on the information I collected, I will conduct an in-depth analysis of the long-term investment value differences between Pop Mart’s ‘content-free IP platformization’ model and Disney’s ‘content-driven IP’ model.

Disney adopts a full industry chain model of ‘content-platform-experience-consumption’ [2]:

- First create content: Create IP through film and television content, investing 5-10 years and hundreds of millions of dollars in movie production

- Then spread IP: Spread through streaming platforms (Disney+, Hulu) and traditional TV networks

- Then experience consumption: Provide immersive experiences through theme parks, resorts and cruise ships

- Finally monetize: Achieve diversified monetization through consumer goods and IP licensing

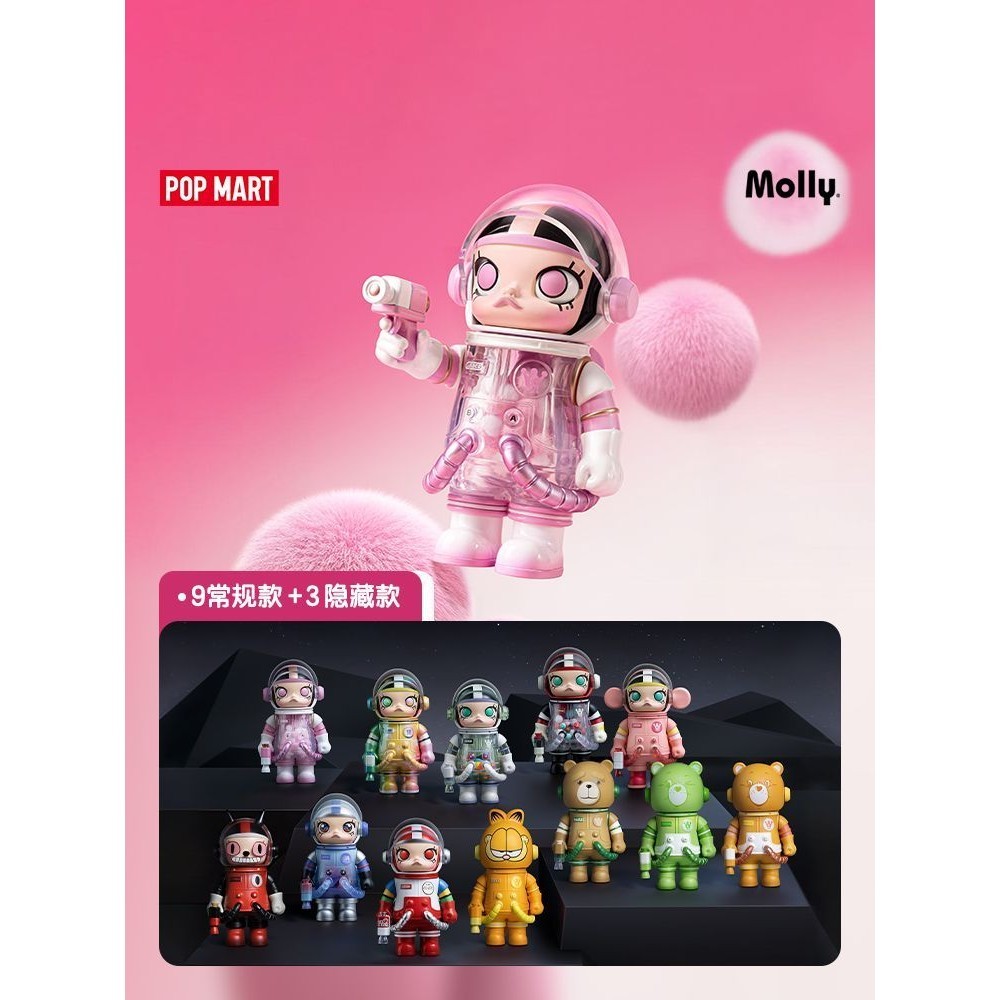

Pop Mart takes a completely different path:

- Visual-driven: Rely on trendy visual design rather than deep story content [1]

- Quick iteration: Design costs are far lower than movie production, allowing ‘small steps, quick iterations’ [1]

- Probability mechanism: Stimulate dopamine effect and addictiveness through blind box mechanism [3]

- Social currency: Easy to become emojis and avatars, achieving viral spread in user-generated UGC [1]

- Long IP life cycle with cross-cycle ability

- Maintain popularity through continuous content updates (5-10 year cycle for new movies) [2]

- “Heavily relies on continuous operations and freshness to ‘survive’” [1]

- “Once operations weaken or designs become outdated, there is a risk of becoming ‘fast fashion’ and being quickly forgotten” [1]

- Netizens’ analysis points out that Labubu’s popularity was highly accidental and can only be summarized after the fact but not predicted [3]

Pop Mart’s blind box mechanism faces major questions:

- “Widely considered to have certain gambling properties, dopamine stimulation effect and addictiveness” [3]

- “Precisely manipulate consumer behavior through psychology and behavioral economics principles” [3]

- Some criticize it for “harvesting emotional taxes from young people” and products lack practical functional value [3]

- Channel advantage: Operates 521 own retail stores and 2,472 robot stores in over 30 countries [6]

- Scaling ability: 2024 revenue of 13.04 billion yuan, overseas revenue accounts for nearly 40% [5]

- Industrialization capability: Achieves marginal cost reduction in horizontal expansion from the income statement [3]

- Contradiction in control over artists: Need to continuously produce hit IPs while maintaining control over artists, which has fundamental contradictions

- IP concentration risk: Over-reliance on individual IPs (e.g., Labubu) brings systemic risks

- Lack of content capability: Lack of deep story content support, making it difficult to form true cultural symbols

Disney’s moat is built on:

- Century-old cultural accumulation: Has complete worldview and storylines

- Multiple monetization channels: Multi-dimensional monetization through movies, streaming media, parks, merchandise, licensing, etc.

- Continuous innovation capability: Continuously produce high-quality content through internal studios (Pixar, Marvel, etc.)

Outstanding performance in H1 2025 [4]:

- Revenue of 13.88 billion yuan, up 204.4% YoY

- Adjusted net profit of 4.71 billion yuan, up 362.8% YoY

- Gross margin of 66.8%, net margin of 26.1%

But the stock price trend is worrying:

- Recent stock price plummeted, dropping over 43% from the high of 339.8 yuan [5]

- Reflects market concerns about its long-term sustainability

- Market capitalization of 199.58 billion USD [0]

- P/E ratio of 16.09x, relatively reasonable

- Net margin of 13.14%, operating margin of 14.65% [0]

- Analyst consensus target price of 139 USD, with 25.6% upside potential [0]

- High capital efficiency; IP creation efficiency is 10 times faster than Disney [2]

- Global IP collectibles market size exceeds 100 billion USD with a CAGR of 8% [6]

- Repurchase rate of 74% in the U.S. market, even exceeding Disney [6]

- Strong overseas expansion momentum; overseas sales grew 234% YoY in 2025 [6]

- Questionable business model sustainability: Whether the model relying on ‘fast emotions’ and ‘sensory stimulation’ can be sustained long-term

- Regulatory risk: Blind box mechanism may face stricter regulation

- Cultural export capability: Lack of deep cultural content, making it difficult to form true global cultural influence

Pop Mart’s ‘content-free IP platformization’ model does have fundamental flaws compared to Disney’s ‘content-driven IP’ model:

-

Shallow emotional connection: Lack of deep cultural and emotional connotations, making it difficult to form cross-cycle brand loyalty

-

Uncertain IP life cycle: Over-reliance on trend trends, easily replaced by new IPs, sustainability is questionable

-

Business ethics risk: Gambling-like sales mechanism faces regulatory and social questions

-

Artist control contradiction: Need to rely on artists’ creativity while maintaining platform control, there is an inherent conflict

Although Pop Mart has performed well in the short term, from a long-term investment perspective, Disney’s ‘content-driven IP’ model has a more solid and sustainable moat. Pop Mart needs to transform to ‘content-driven’, such as the already started film studio and Labubu filmization strategy, to truly build long-term value [5].

Investors should pay attention to whether Pop Mart can successfully complete the leap from ‘design-driven’ to ‘content-driven’, which is the key to its ability to achieve long-term value [1].

[0] Jinling API Data - Disney Company Overview and Real-Time Stock Price Information

[1] 36Kr - “Revealing Two IP Models: Image IP Pop Mart VS Story IP Disney Marvel”

[2] Huxiu - “Disney’s Business Model Is More Stable Than Pop Mart’s”

[3] Zhejiang University School of Management - “Pop Mart Financial Report Perspective: Understand the ‘Emotional Economy’ Code Behind Trendy Toys in One Article”

[4] NetEase - “Outstanding Financial Report But Plummeting Stock Price: What’s Wrong With Pop Mart?”

[5] Investing.com - “Luxury ‘Godfather’ Wu Yue’s New Task: Teach Pop Mart’s Brand and Overseas Lessons Well”

[6] Yahoo Finance - “Kidult Economy Rises! Morgan Stanley: Global IP Collectibles Output Value Exceeds 100 Billion USD”

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.