Investment Value Analysis of A-share Related Industry Chain Companies Amid Space Solar Power Station Technology Development

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

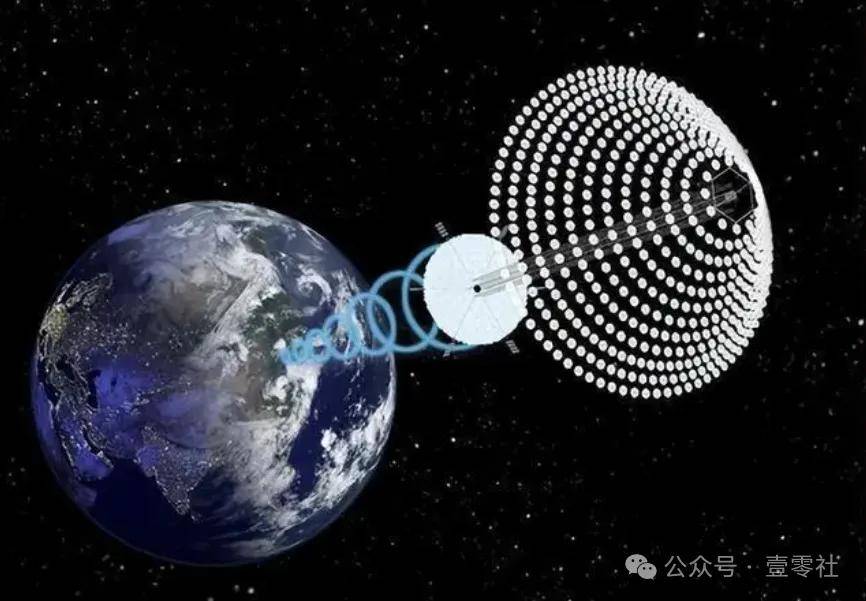

As a key development direction for future clean energy, the Space Solar Power Station (SSPS) collects solar energy by deploying photovoltaic arrays in space and wirelessly transmits energy back to Earth via phased array antennas, featuring advantages such as 24/7 uninterrupted power generation and no weather impact [1]. China’s “Zhuori Project” is actively advancing this technology, with expected wide application prospects in space charging piles, space computing centers, directed energy weapons, and other fields [1].

- Zhenlei Technology focuses on R&D, production, and sales of RF integrated circuit chips and microsystems. Its main products include RF transceiver chips, high-speed high-precision ADC/DAC chips, power management chips, microsystems, and modules [1]

- The company provides complete chip and microsystem products and technical solutions from antennas to signal processing, with core technical advantages in the phased array communication field [1]

- In H1, it achieved operating revenue of 205 million yuan, a year-on-year increase of 73.64%; net profit attributable to parent company was 62.3197 million yuan, a year-on-year increase of 1006.99%, with outstanding performance [4]

- Q2 operating revenue was 132 million yuan, up 106.2% year-on-year; net profit attributable to parent company was 39.85 million yuan, up 252.5% year-on-year [4]

- By downstream application field, revenue from the special industry and satellite communication fields each accounts for approximately half [4]

- High Technology Matching Degree: The company’s products have been widely applied in digital phased array, satellite communication, commercial aerospace, and other fields, which highly match the phased array antenna technology required for space solar power stations [1]

- Layout in Satellite Communication Field: The company focuses on expanding the satellite communication field; its products have promoted the miniaturization and lightweight development of satellites and payload systems, and it has established cooperative relationships with major domestic research institutes [1]

- Market Position Advantage: It has become one of the core suppliers of RF chips, microsystems, and modules in domestic industry communication and radar fields, and occupies an important position in domestic basic components [4]

- The company is the largest domestic enterprise capable of mass-producing gallium arsenide solar cell epitaxial wafers; its gallium arsenide solar cell efficiency reaches 31%, ranking first in the industry [6]

- Gallium arsenide solar cell epitaxial wafers and chips have been mass-applied in the commercial aerospace field, with shipments ranking first in the domestic market [5]

- It has a market share of over 60% in low-orbit satellite energy systems; the value of a single satellite battery ranges from 3 million to 6 million yuan, and it has passed SpaceX certification [6]

- In the first three quarters of 2025, revenue was 2.75 billion yuan, up 46.36% year-on-year; net profit attributable to parent company was 87.9497 million yuan, up 80.17% year-on-year [5]

- Mini LED backlight and Micro LED chips are rapidly ramping up shipments, showing strong growth momentum [5]

- The triple-junction gallium arsenide solar cell epitaxial wafers produced by the company are mainly applied in aerospace fields, such as low-orbit satellites of StarNet and G60 [5]

- Core Technical Advantage: Gallium arsenide solar cells have high efficiency and radiation resistance, making them very suitable for energy collection in space environments [6]

- Leading Market Position: It occupies more than 50% market share in the gallium arsenide solar cell field, with leading radiation resistance performance [6]

- Successful Application Verification: Its products have been successfully applied to multiple satellites developed by China, with mature space application experience [5]

- Explosive Performance Growth: Net profit increased by more than 10 times in H1 2025, showing strong growth potential [4]

- High Technical Barriers: RF chips and phased array technology have high entry barriers, and the company has a competitive moat in niche fields [1]

- Benefiting from Industry Trends: Rapid development of satellite internet, commercial aerospace, and other fields drives demand growth [4]

- Gross Margin Decline: Gross margin was 84.54% in H1 2025, down 2.86 percentage points from Q1 [4]

- Customer Concentration Risk: Military orders have cyclical impacts, and high customer concentration may lead to performance fluctuations

- Stable Market Position: It has a market share of over 60% in the gallium arsenide solar cell field, with significant competitive advantages [6]

- Technological Leadership: Its battery efficiency of 31% ranks first in the industry, and it has passed SpaceX certification, with technical strength recognized internationally [6]

- Diversified Development: New businesses such as Mini LED and Micro LED are growing rapidly, reducing single-business risks [5]

- Technology Iteration Risk: Photovoltaic technology updates rapidly, requiring continuous R&D investment to maintain a leading position

- Policy Dependence: Commercial aerospace development is greatly affected by policy support

- Zhenlei Technology: Benefiting from accelerated satellite internet construction, its performance growth has strong certainty; it is recommended to pay attention to order execution and gross margin changes

- Qianzhao Optoelectronics: Space solar power station technology is still in the early stage; in the short term, benefits will come more from the continuous growth of existing satellite applications

Both companies will significantly benefit from the commercialization process of space solar power station technology, among which:

- Zhenlei Technology’s technical advantages in the phased array antenna field will directly translate into the core value of the space solar power station energy transmission system

- Qianzhao Optoelectronics’ gallium arsenide solar cells will become key components for energy collection in space solar power stations

- Technology Maturity Risk: Space solar power station technology is highly complex, and the commercialization process may be slower than expected

- Policy Support Intensity: Continuous policy support and capital investment are required

- Market Competition Risk: As the market prospect becomes clear, competitors may increase, affecting the market share of existing companies

The development of space solar power station technology has a positive impact on the investment value of both Zhenlei Technology and Qianzhao Optoelectronics. With its advantages in phased array technology, Zhenlei Technology will become a key supplier of the energy transmission system for space solar power stations; Qianzhao Optoelectronics, with its leading position in gallium arsenide solar cell technology, will play an important role in the energy collection link. From the perspective of investment timing, Zhenlei Technology’s performance has entered an explosive period, with more clear short-term investment value; Qianzhao Optoelectronics requires long-term attention to the progress of the commercialization of space solar power stations.

[1] Jinshi Data. Commercial Aerospace Industry Chain Analysis. https://jssj666.com/

[2] 21st Century Business Herald. Zhenlei Technology’s H1 Net Profit Increased by Over 10 Times. https://www.cls.cn/detail/2113226

[3] Caifuhao. Panorama of Space Computing Concept Stocks. https://caifuhao.eastmoney.com/news/20251212090532203110830

[4] Time Online. Satellite Internet Boom? Zhenlei Technology’s H1 Revenue Surged by 70%. https://www.time-weekly.com/post/323490

[5] Dabendan Stock. Analysis of Reasons for Qianzhao Optoelectronics’ Price Limits. https://dabanke.com/gupiao-300102.html

[6] RFID World Network. Net Profit Soared by 1007%! RF Chip Enterprise Makes Big Money Quietly. https://m.rfidworld.com.cn/news/2508_CD4BC988797ABD23.html

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.