North American Natural Gas Power Plant Supply Chain Bottlenecks and AI Data Center Power Demand Investment Analysis

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

According to the latest market data, the power demand of U.S. data centers is experiencing unprecedented growth. Research shows that by 2035, the power demand of new data centers is expected to increase by 1000% from the end of 2024[1]. Business analysis indicates that as of 2024, there are 1,240 data centers in planning or operation in the U.S., and if all approved facilities are put into operation, the annual power demand could reach 149.6-239.3 terawatt-hours, equivalent to the annual electricity consumption of Ohio or Florida[1].

Grid operators’ forecasts also confirm this trend:

- ERCOT (Texas):Added nearly 37 GW of power demand in its 2024 five-year forecast

- PJM (13-state region):Added more than 15 GW of power demand, covering areas including Virginia, the “world’s data center capital”[1]

Natural gas power generation has become the default choice to fill the dispatchable power gap, but it faces severe supply chain constraints:

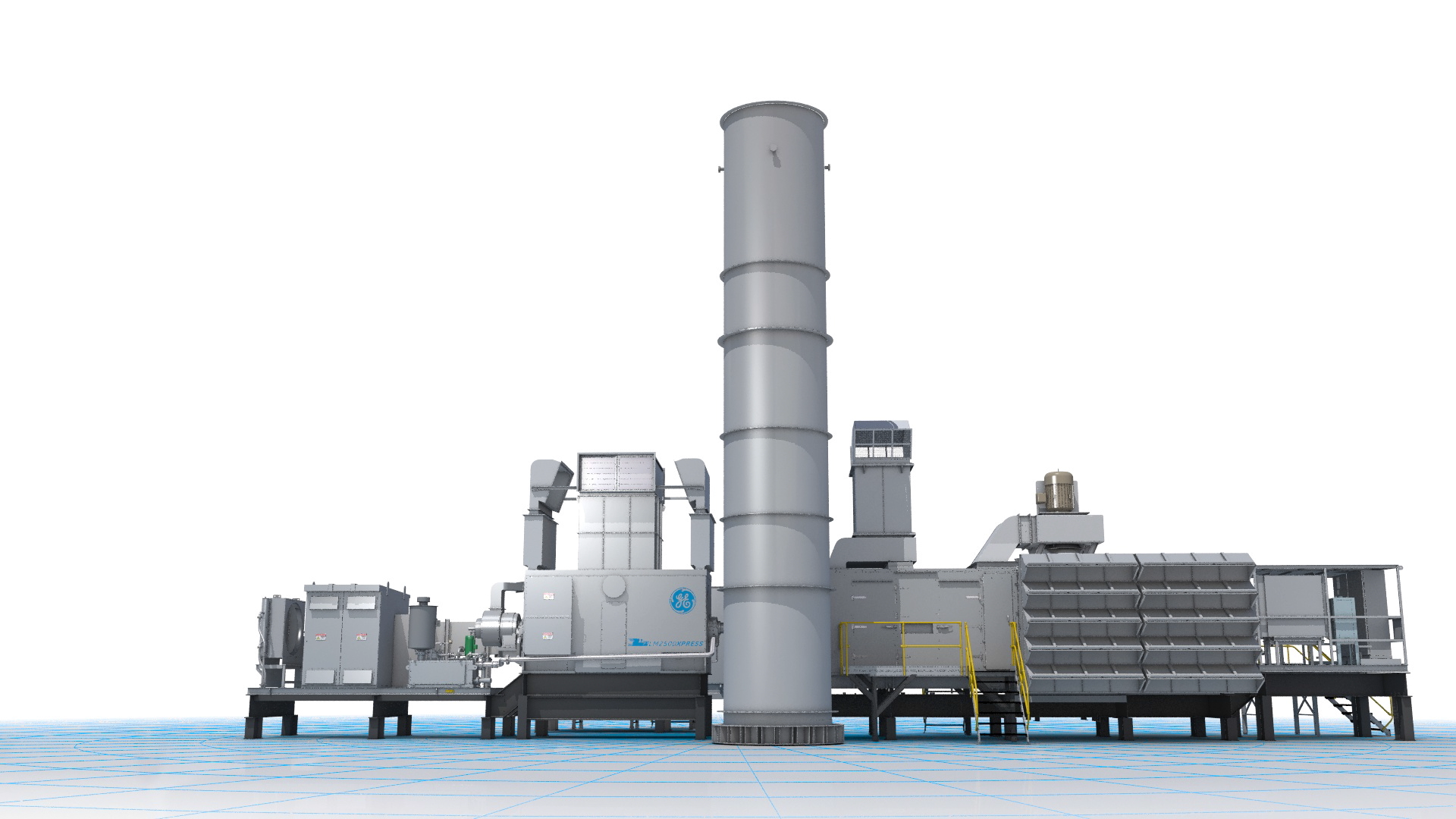

- GE Vernova received 7 GW of gas turbine orders in Q1 2025, including 29 LM2500XPRESS aero-derivative units for Crusoe AI data centers[2]

- Mitsubishi Power announced it will double its gas turbine production[2]

- Siemens Energy’s new gas turbine orders increased by 17% year-on-year, with at least one-third coming from data center demand[2]

- GE Vernova’s gas turbine order backlog has grown from 55 GW in Q2 to 62 GW[4]

- The delivery cycle for heavy-duty gas turbines has reached 243 weeks (nearly 5 years), mainly constrained by key component manufacturing and assembly capacity

Transformer supply has become another key constraint:

- Delivery time for large transformers has extended from the original 3-6 months to 12-30 months, an increase of 429%[3]

- The delivery cycle for large power transformers has reached 80-120 weeks, and some even take 210 weeks (4 years)[3]

- Small transformers for distribution networks also face backlogs of up to 2 years[3]

- Special electrical steel (critical for reducing transformer power loss) remains expensive and difficult to obtain domestically[3]

Based on supply chain bottleneck analysis, the total capacity ceiling for new natural gas power plants in North America from 2025 to 2030 is approximately 58 GW, which contrasts sharply with the rapid growth of data center demand:

- Utility Dive reports show that utilities’ forecast for new data center load by 2030 is 90 GW, accounting for nearly 10% of the projected peak load[5]

- Data center market analysts believe that the growth of data centers by 2030 is unlikely to require more than 65 GW[5]

- More than 200 natural gas power generation units are in different stages of development in the U.S.[2]

- However, constrained by gas turbine and transformer supply, the actual completed capacity will be limited to around 58 GW

- GE Vernova: Gas turbine order backlog of 62 GW, business revenue more than tripled from a year ago[4]

- Siemens Energy: New orders increased by 17%, with significant contributions from data centers[2]

- Mitsubishi Power: Announced it will double capacity to meet demand[2]

Search results show that Chinese equipment manufacturers like Jereh Group are actively expanding into this market[5], with specific manifestations as:

- High-end equipment manufacturing and technical service capabilities

- Technical accumulation in natural gas power generation equipment and gas turbine fields

- Participation in the construction of data center power ecosystems

- NextEra Energy and Basin Electric are collaborating to develop a 1.5 GW gas project to serve data centers in North Dakota[5]

- Demand for various power engineering services has surged

- Demand for upgrading and retrofitting existing power plants

- Data center backup power system integration

- Transformers and switchgear are returning to localized production[3]

- Domestic investment in key raw materials such as electrical steel

- Modular gas-fired power generation units (the >330kVA market is growing the fastest)[2]

- Rapidly deployable distributed generation solutions

- Core Equipment Suppliers: Prioritize gas turbine manufacturers with existing capacity and technical barriers

- Service Providers: Power engineering construction and operation & maintenance service companies

- Supply Chain Solutions: Transformer manufacturers and key material suppliers

- Technology Innovation Companies: Modular power generation, rapid deployment technologies

- Localized Production Capacity: Equipment manufacturers returning to local production

- Comprehensive Energy Solutions: Natural gas + energy storage + renewable energy integration service providers

Chinese manufacturers like Jereh Group face the following opportunities:

- Technology Export: Export mature high-voltage equipment and power generation technologies to the North American market

- Supply Chain Cooperation: Establish partnerships with international manufacturers to provide key components

- Emerging Market Penetration: Use cost advantages to enter fast-growing market demand

- Technology Substitution Risk: The restart of nuclear power may divert demand in the medium to long term (2035-2040)[1]

- Policy Risk: Environmental protection policies may restrict the development of natural gas power generation

- Intensified Market Competition: Capacity expansion by traditional power equipment giants may change the supply-demand pattern

- Supply Chain Recovery Risk: If bottleneck issues are resolved quickly, oversupply may occur

The supply chain bottlenecks of North American natural gas power plants have created clear investment opportunities for the growth of AI data center power demand. There is significant arbitrage space between the 58 GW capacity ceiling and the huge demand gap, and equipment manufacturers, service providers, and supply chain optimization enterprises will all benefit from it. Chinese equipment manufacturers like Jereh Group are expected to find development opportunities in this round of growth relying on technical and cost advantages, but need to pay attention to potential risks brought by technology substitution and policy changes.

[1] Business Insider - “The AI bubble you haven’t heard about” (https://www.businessinsider.com/ai-boom-bubble-power-utilities-forecasting-demand-2025-11)

[2] POWER Magazine - “Mitsubishi Will Double Gas Turbine Production as Demand Grows” (https://www.powermag.com/mitsubishi-will-double-gas-turbine-production-as-demand-grows/)

[3] The Conversation - “Supply-chain delays, rising equipment prices threaten electricity grid” (https://theconversation.com/supply-chain-delays-rising-equipment-prices-threaten-electricity-grid-269448)

[4] Politico - “AI juices business for GE spinoff” (https://www.politico.com/newsletters/power-switch/2025/10/22/ai-juices-business-for-ge-spinoff-00618110)

[5] Utility Dive - “NextEra aims to build up to 30 GW in data center power supply hubs by 2035” (https://www.utilitydive.com/news/nextera-basin-electric-data-center/807405/)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.