In-depth Analysis of Supply Chain Bottlenecks in North American Natural Gas Power Plants and Investment Opportunities in Data Center Power

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

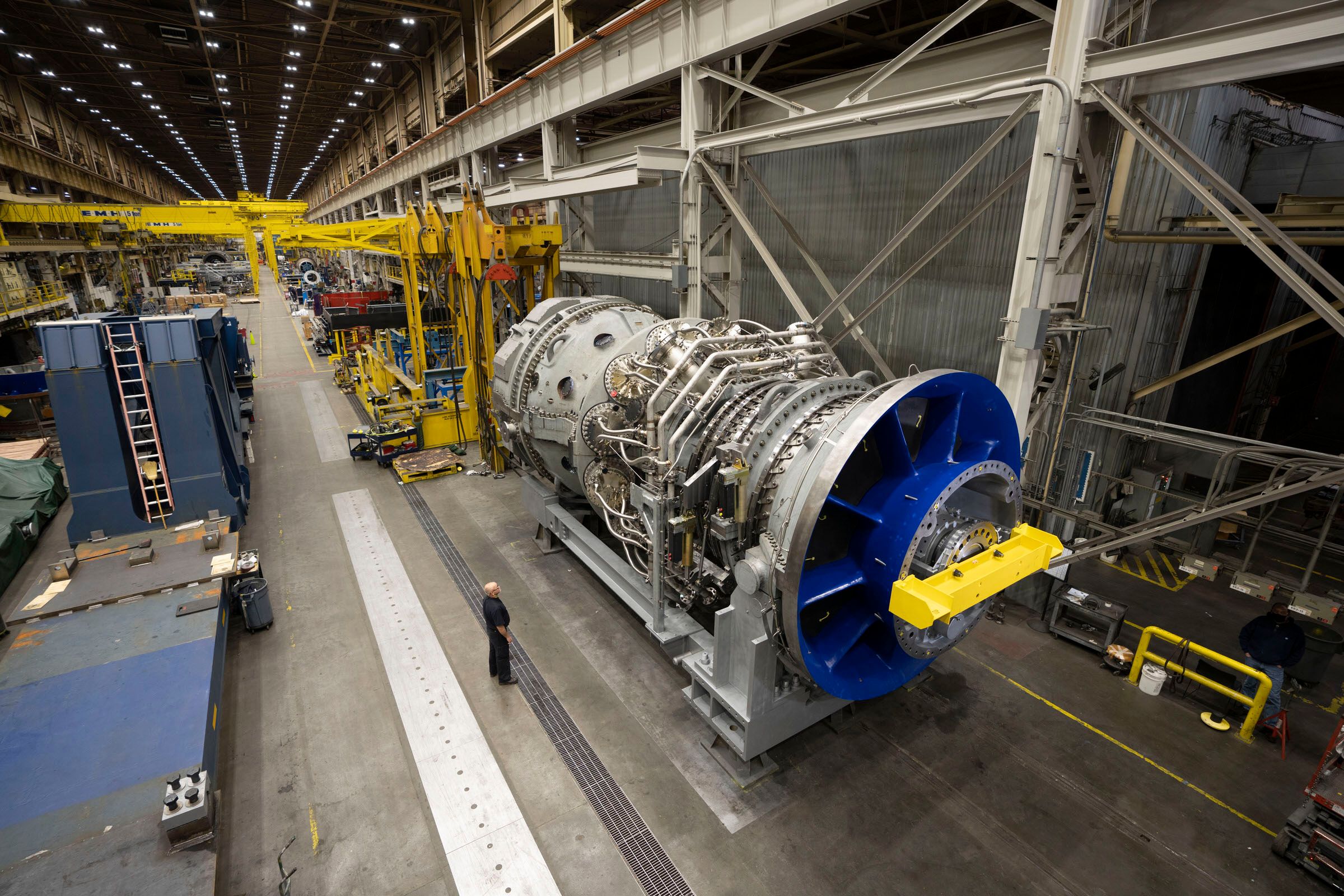

The shock of power demand from the explosive growth of North American data centers is reshaping the investment landscape for energy infrastructure. Natural gas power plants, as the preferred solution to fill the dispatchable power gap, are facing severe supply chain bottlenecks, creating unprecedented investment opportunities for related energy infrastructure companies.

According to the latest data, the delivery cycle for heavy-duty gas turbines has reached

Power transformers, as key components for grid upgrades, are also facing severe bottlenecks. This dual constraint is pushing up the cost and time thresholds for the entire energy infrastructure.

- GE Vernovahas risen81.21%year-to-date, with a current market capitalization of$166.6 billionand a P/E ratio of98.04x[0]

- Siemens Energyhas seen an even steeper gain of159.08%year-to-date, with a market capitalization of$117 billionand a P/E ratio of71.31x[0]

The stock performance of both companies has fully reflected market expectations of supply tightness, but based on long-term demand growth, there is still room for further valuation upside.

Jereh Group, through strategic cooperation with Baker Hughes and Siemens Energy, has secured over

- Goldman Sachs predicts that natural gas will meet approximately 60% of the new power demand from data centers[1]

- Tech giants like Microsoft will invest $15.2 billionin UAE data center construction in 2025 [2]

- U.S. power demand growth comes not only from AI but also from new factory construction and the popularization of electric vehicles [3]

AI data centers are transforming energy storage systems from backup power sources to core energy infrastructure [1]. North America is expected to become the world’s largest market for energy storage in AI data centers.

Long-term supply chain constraints have given leading manufacturers significant pricing power. With delivery cycles as long as 4-5 years, customers are willing to pay a premium to secure equipment supply.

High capacity utilization and long delivery cycles mean these companies have 3-5 years of order visibility, providing strong support for their valuations.

Supply chain bottlenecks have actually strengthened the moats of existing manufacturers, making it difficult for new competitors to enter the market in the short term.

- Direct Investment in Leading Manufacturers: GE Vernova and Siemens Energy

- Focus on Supply Chain Integrators: Companies that can accelerate delivery cycles and provide integrated solutions

- Used Equipment Market: Trading and service opportunities for refurbished equipment

- Capacity Expansion Investments: Follow manufacturers’ capacity expansion plans

- Alternative Technologies: Small modular reactors, energy storage systems, and other alternatives

- Grid Modernization: Smart grids and distributed energy resource management

- Energy Structure Transformation: Gradual transition from natural gas to clean energy

- Data Center Self-generation: Large tech companies building their own power generation facilities

- Regional Grid Restructuring: Construction of specialized grids to meet the needs of data center clusters

- Environmental policies may impose restrictions on natural gas power plant construction

- Carbon neutrality policies may accelerate the transition to renewable energy

- Emerging technologies (such as nuclear fusion and advanced energy storage) may change the competitive landscape

- Improvements in data center energy efficiency may lower expectations for power demand growth

- Overcapacity risk (if manufacturers overexpand capacity)

- Geopolitical factors affecting supply chain stability

Supply chain bottlenecks in North American natural gas power plants are creating a unique investment window.

Based on the current supply-demand imbalance and long-term demand growth trends, leading manufacturers such as

Investors should focus on:

- The duration of supply chain constraints

- The actual growth trajectory of data center power demand

- The development progress of alternative technologies

- Changes in the policy environment

This investment theme has

[0] 金灵API数据

[1] Yahoo Finance - “AI to Reshape the Global Technology Landscape in 2026” (https://finance.yahoo.com/news/ai-reshape-global-technology-landscape-141700345.html)

[2] Forbes - “Gas Turbines Power UAE Data Centers Despite…” (https://www.forbes.com/sites/guneyyildiz/2025/12/09/uae-2026-what-powers-microsofts-15-billion-abu-dhabi-data-centers/)

[3] Bloomberg - “The Boom in US Power Demand Isn’t Just About AI” (https://www.bloomberg.com/news/newsletters/2025-12-11/ai-isn-t-the-only-driver-of-us-power-demand)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.