In-depth Analysis of Strategic Significance and Investment Value of Shenzhen Urban Transport's (301091) RMB 1.8 Billion Private Placement

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Shenzhen Urban Transport (301091) announced on December 17, 2025, its plan to raise no more than RMB 1.8 billion through a private placement, which will be mainly invested in four major areas [1][2]:

- Transportation Industry Large Model and Ecological Application for Global Intelligent Agent Collaboration

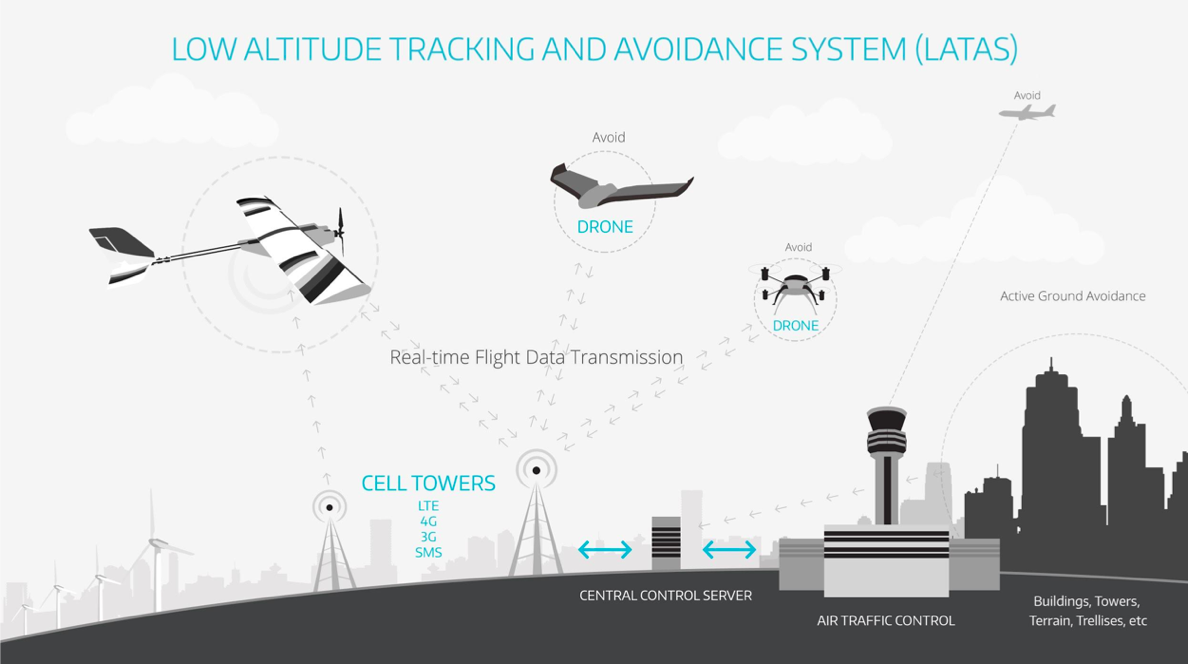

- R&D and Large-scale Application of Embodied Intelligent Transportation Equipment such as Low-altitude and Autonomous Driving

- Global Business Expansion Project

- Supplementary Working Capital

The number of shares issued in this private placement will not exceed 158 million, targeting no more than 35 specific investors [2].

- The market size of China’s low-altitude economy is expected to reach RMB 1.5 trillion in 2025 and exceed RMB 2 trillion in 2030 [3]

- The national low-altitude economy market size reached RMB 670.25 billion in 2024, showing a high growth trend [3]

- Policy support is unprecedented; the “Suggestions of the Central Committee of the Communist Party of China on Formulating the 15th Five-Year Plan for National Economic and Social Development” clearly proposes to “accelerate the cluster development of strategic emerging industries such as new energy, new materials, aerospace, and low-altitude economy” [3]

- On December 15, 2025, the Ministry of Industry and Information Technology officially announced China’s first batch of access permits for L3-level conditional autonomous driving models [4][5]

- China has become the second country in the true sense to allow L3-level autonomous driving after Germany, and the first country in the world to allow L3-level autonomous driving on a large scale [4]

- In the first three quarters of 2025, the sales volume of new passenger cars with combined driving assistance functions (L2) increased by 21.2% year-on-year, with a penetration rate of 64% [5]

Shenzhen Urban Transport’s private placement marks the company’s strategic transformation from a traditional urban transportation planning service provider to an intelligent transportation technology company, focusing on two cutting-edge technology areas:

- Transportation Large Model: For global intelligent agent collaboration, it is expected to play a core role in traffic management and smart city construction

- Embodied Intelligent Equipment: Covering low-altitude aircraft and autonomous driving equipment, seizing the commanding heights of emerging technologies

Expanding international business through fund-raising will help the company seize the opportunities of the “Belt and Road” initiative and global smart city construction, and achieve business diversification.

- The market size is expected to reach RMB1.5 trillion in 2025 and RMB3.5 trillion in 2035 [6]

- The drone industry is expected to exceed RMB1 trillion first in 2030 [6]

- Application scenarios have expanded from aerial photography and surveying to dozens of fields such as logistics distribution, agricultural plant protection, emergency rescue, and power inspection [6]

- The market size of Robotaxi is expected to reach RMB270 billion in 2030 [7]

- The output value increment of China’s unmanned logistics vehicle industry is expected to rise to RMB594.8 billion in 2030 [7]

- The sales proportion of L2++ and above models continues to increase, reaching 38.65% from January to September 2025 [7]

- Current market value is about RMB17.732 billion, stock price is RMB33.63 [8]

- P/E ratio (TTM) is 167.33 times, P/B ratio is7.68 times [8]

- Net assets per share is RMB4.38, earnings per share is RMB0.20 [8]

- The company has profound technical accumulation and project experience in the intelligent transportation field

- As a national low-altitude economy pilot city, Shenzhen provides a good development environment for the company [1]

- Has established cooperative relationships with many low-altitude economy enterprises, such as Volocopter China, FAW Qiyi, etc. [1]

- Capital Advantage: The RMB1.8 billion fund-raising will provide sufficient capital support for the company’s R&D, accelerating the technology implementation and industrialization process

- Valuation Upgrade: By laying out in high-growth tracks, it is expected to upgrade the company’s valuation level and transform from the traditional infrastructure sector to the technology sector

- First-mover Advantage: Seize the commanding heights of low-altitude economy and autonomous driving technologies, and establish technical and application barriers

- Artificial intelligence and autonomous driving technologies are still in a period of rapid development, and there are uncertainties in technical routes

- The issue of responsibility definition in the practical application of L3-level autonomous driving is still controversial [4]

- The progress of low-altitude airspace management reform may affect the industry development

- The relevant regulatory and standard systems still need to be improved

- The low-altitude economy and autonomous driving fields are highly competitive, and tech giants are laying out their strategies one after another

- The speed of technology iteration is fast, requiring continuous high R&D investment

- The current valuation level is relatively high, and there is a risk of correction

- Increased R&D investment may affect short-term profitability

This private placement of Shenzhen Urban Transport reflects the management’s profound insight into industry development trends and strategic forward-looking. By laying out in the two trillion-level markets of low-altitude economy and autonomous driving, the company is expected to achieve a successful transformation from a traditional infrastructure service provider to an intelligent transportation technology company.

Investors should focus on the following key nodes:

- Commercialization progress and policy implementation of L3-level autonomous driving

- Construction progress of low-altitude economy infrastructure

- Company’s technical breakthroughs and project implementation status

- Efficiency of private placement fund use and progress of investment projects

- Short-term: Focus on trading opportunities brought by policy catalysis

- Medium-term: Focus on the progress of technology industrialization and performance realization

- Long-term: Focus on the company’s position and competitive advantages in the intelligent transportation ecosystem

Shenzhen Urban Transport’s RMB1.8 billion private placement has far-reaching strategic significance and significant investment value. This fund-raising not only provides sufficient capital support for the company to seize the two trillion-level markets of low-altitude economy and autonomous driving, but more importantly, marks the company’s strategic transformation to an intelligent transportation technology company.

Driven by both policy support and technological progress, the low-altitude economy and autonomous driving markets are on the eve of an explosion. Shenzhen Urban Transport, relying on its technical accumulation and project experience in the transportation field, is expected to occupy a favorable position in this round of industrial transformation.

Although facing technical risks and competitive challenges, considering the huge market space and the forward-looking nature of the company’s strategic layout, Shenzhen Urban Transport has the potential to become a leading enterprise in the intelligent transportation field, which is worthy of long-term attention and strategic allocation.

[1] NetEase News - “Shenzhen Urban Transport: Plans to Raise No More Than RMB1.8 Billion Through Private Placement for R&D and Large-scale Application of Embodied Intelligent Transportation Equipment Such as Low-altitude and Autonomous Driving” (https://www.163.com/dy/article/KH0MBVJ8053469RG.html)

[2] Securities Times - “Shenzhen Urban Transport Plans to Raise RMB1.8 Billion via Private Placement to Boost Transportation Large Models and Embodied Intelligent Equipment” (https://stcn.com/article/detail/3545474.html)

[3] Sina Finance - “Policy and Technology Support Drive High Growth of Low-altitude Economy Market Size” (https://finance.sina.com.cn/jjxw/2025-11-25/doc-infyqcqq3367326.shtml)

[4] Securities Times - “L3-level Autonomous Driving is Here! Only 2 Models Get the First Batch of ‘Admission Tickets’ Will This Industry ‘Change’?” (https://www.xincai.com/article/nhaxvcr3484491)

[5] Yangcheng Evening News - “First Batch of L3 Autonomous Driving Models Approved, What Challenges Will L3 Face in Practical Application?” (https://news.ycwb.com/ikinvjitjn/content_53852773.htm)

[6] Baidu Encyclopedia - “Low-altitude Economy” (https://baike.baidu.com/item/低空经济/50884294)

[7] Securities Times - “Unmanned Driving Concept Rises, Wanjie Technology Rises by 20% with Limit-up, Haoen Auto Electronics and Others Surge” (https://www.stcn.com/article/detail/3542145.html)

[8] Xueqiu - “Shenzhen Urban Transport (SZ301091) Stock Price” (https://xueqiu.com/S/SZ301091)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.