Impact of Commercialization of Controlled Nuclear Fusion on China's Clean Energy Investment Landscape

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Based on the latest collected data, I will conduct an in-depth analysis of the far-reaching impact of the commercialization progress of controlled nuclear fusion technology on the investment landscape of China’s clean energy industry.

China has become the world’s largest clean energy investor. In 2024, China’s clean energy investment scale reached approximately 625 billion USD, accounting for nearly one-third of the global clean energy investment scale, continuously consolidating its position as a global leader in clean energy investment [1]. In terms of investment structure, solar energy accounts for about 40% and wind energy about 30%, forming the main body of current clean energy investment [1].

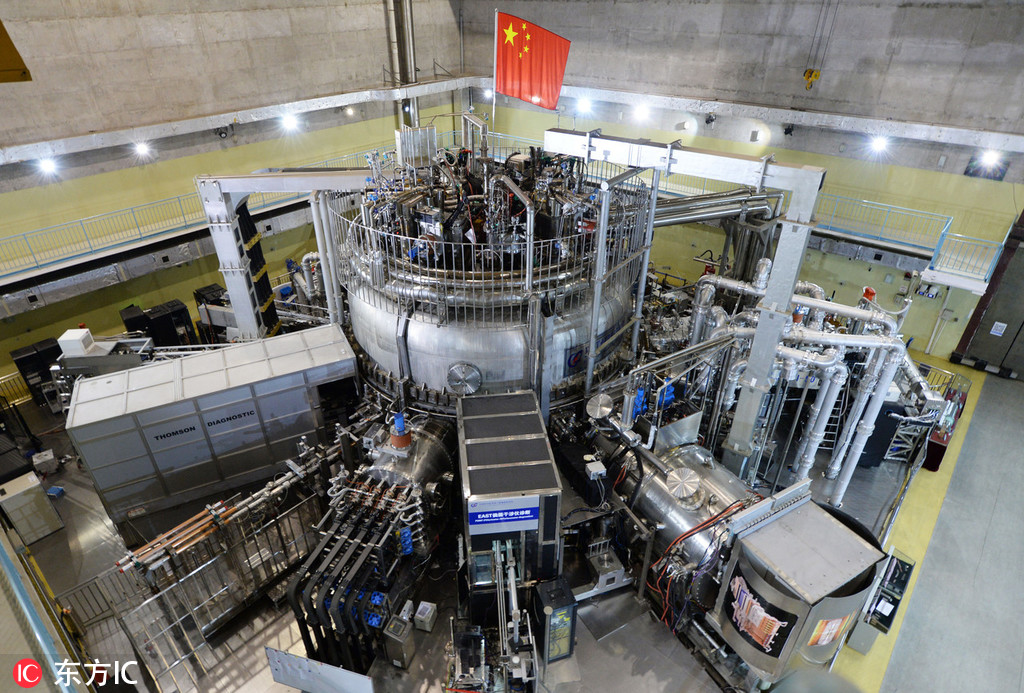

The global nuclear fusion race continues to heat up. According to the International Atomic Energy Agency (IAEA) forecast, by 2050, the global nuclear fusion market size is expected to exceed 40 trillion USD [2]. As of 2024, China’s cumulative investment in nuclear fusion has reached 24.9 billion USD (about 179 billion RMB), second only to the United States, and China’s investment in nuclear fusion is expected to further increase in 2025 [3].

Notably, the emergence of innovative enterprises like “Zero Point Fusion (零点聚能)” has adopted a new route of magnetic zero-point configuration fusion. It is reported that under the same parameters, the confinement time is an order of magnitude higher and the device cost is an order of magnitude lower, with the goal of achieving a power generation cost of “1 cent per kWh” [3]. The emergence of this disruptive technology marks that China’s nuclear fusion commercialization process has entered a new stage.

Traditional clean energy investments mainly focus on mature technologies such as solar energy and wind energy, while the emergence of nuclear fusion will completely change this pattern. Currently, about 70% of nuclear fusion companies expect to complete the grid connection of the first demonstration reactor by 2035 [4], which means investors will face two distinct choices:

It is expected that from 2025 to 2030, nuclear fusion will attract annual capital expenditure of nearly 10 billion yuan [2], forming a new investment track parallel to traditional clean energy.

The high-risk and high-return characteristics of nuclear fusion will promote the differentiation of investor groups:

The capital market has already responded. As of October 2025, the nuclear fusion sector has soared by 60.62% overall, with main capital inflows exceeding 20 billion yuan. The stock prices of 10 component stocks such as Zhongzhou Special Materials (中洲特材) and Yongding Co., Ltd. (永鼎股份) have doubled, with the highest increase reaching 271.94% [4].

The investment focus of nuclear fusion is essentially different from that of traditional clean energy. Traditional clean energy mainly invests in the power generation end, while the core investment opportunities of nuclear fusion lie in upstream equipment manufacturing:

This difference will guide capital to shift from downstream power generation to upstream equipment manufacturing, spawning new investment hotspots.

Unlike the relatively single technical path of traditional clean energy, nuclear fusion has a pattern of parallel development of multiple technical routes:

This diversified pattern provides investors with more choices, but also increases the complexity of investment decisions. The success probability and timeline of different technical routes vary significantly, requiring investors to have stronger technical judgment capabilities.

Traditional clean energy projects usually achieve commercial operation within 3-5 years, with a relatively short investment recovery cycle. However, the commercialization process of nuclear fusion is significantly longer:

- 2025-2030: Test reactor construction phase, mainly R&D investment

- 2030-2045: Engineering reactor construction phase, gradually realizing commercialization

- 2050: Commercialization achieved, large-scale construction of nuclear fusion power plants begins [2]

This long-term nature requires investors to have stronger patience and capital strength, and at the same time provides opportunities for strategic investors who can hold for a long time to obtain excess returns.

China has established obvious scale advantages in traditional clean energy fields such as PV and wind energy, but in the field of nuclear fusion, China still has a certain gap with developed countries such as the United States. Among the 167 fusion device projects globally, the United States has the largest number, and China ranks fourth with 13 [4].

Nuclear fusion will become a new battlefield for China’s international competition in energy technology. China has entered the first echelon of global nuclear fusion technology through independent innovation [2], but continuous investment is still needed to achieve overall leadership.

The traditional clean energy industrial chain has a certain degree of resource dependence, such as PV requiring polysilicon and wind energy requiring rare earths. However, the core of the nuclear fusion industrial chain lies in technological autonomy, especially:

This transformation will promote China’s clean energy industry from resource-dependent to technology-independent, enhancing the overall security of the industrial chain.

- Superconducting Material Industrial Chain: High-temperature superconducting tapes are core materials for nuclear fusion devices, and enterprises such as Shanghai Superconductor (上海超导) have industrialization capabilities

- Precision Manufacturing Equipment: Including high-end equipment manufacturing such as vacuum chamber manufacturing and magnet winding

- Control Systems: Requiring complex plasma control and diagnostic systems

- New Material Field: Including special materials such as first wall materials and divertor materials

- Technical Risk: Nuclear fusion technology is still in the early stage, and there is uncertainty in technical routes

- Timing Risk: The commercialization process may be longer than expected, affecting the investment recovery cycle

- Policy Risk: Continuous government policy support and capital investment are needed

- Competition Risk: Global technological competition is fierce, and there is a risk of being overtaken by other technical routes

The commercialization progress of controlled nuclear fusion technology will have a revolutionary impact on the investment landscape of China’s clean energy industry. This is not only the emergence of a new energy technology, but also the reconstruction of the entire energy investment logic. In the short term, nuclear fusion is still difficult to shake the dominant position of traditional clean energy such as PV and wind energy; but in the long term, with continuous technological breakthroughs and cost reductions, nuclear fusion is expected to become the next growth driver for clean energy investment.

For investors, while maintaining investments in traditional clean energy, they need to actively pay attention to the development trends of nuclear fusion technology, timely deploy key links in the nuclear fusion industrial chain, and seize this historic investment opportunity under the premise of risk control.

[1] iiMedia Research, China’s Clean Energy Investment Scale Reaches 625 Billion USD, 2024

[2] Securities Times, Controlled Nuclear Fusion Spawns Trillion-level New Track: Funds “Position in Advance” on the Eve of Commercialization, 2025

[3] Huaan Securities Research Institute, Energy Transition: Accelerated Development of Controlled Nuclear Fusion, June 2025

[4] iiMedia Research, Understand China’s Controlled Nuclear Fusion Industrial Chain in 5 Minutes: Countdown to “2035 Power Generation”, October 2025

[5] Bank of China Securities, In-depth Report on the Controlled Nuclear Fusion Industry, April 2025

[6] 36Kr, Controlled Nuclear Fusion Breakthrough Imminent, Reconstructing the Global Energy Pattern, 2025

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.