Envicool (002837.SZ) Hot List Analysis: Driving Factors and Market Prospects

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Envicool (002837.SZ) made it to the hot list on December 18, 2025. The previous day (December 17), the stock hit a 10% daily limit, closing at 92.95 yuan and setting a new 52-week high [0].

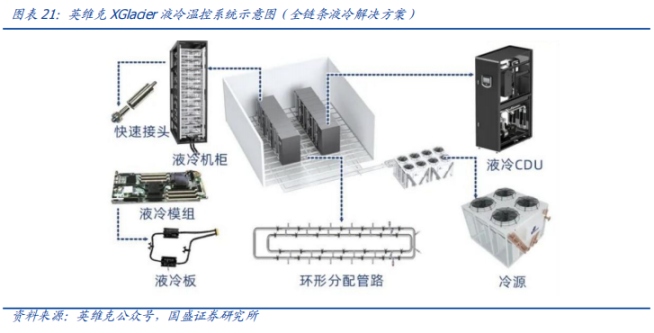

- Industry Trend Drivers: Envicool focuses on thermal management technology. This field has strong demand due to the rapid expansion of AI data centers. As AI technology develops, data centers need efficient cooling systems to handle equipment heat, leading to a surge in demand for thermal management devices [1][2][3].

- Strong Price Momentum: The stock has a strong long-term trend, with a YTD gain of 216.91%, 6-month gain of 223.87%, short-term 5-day gain of 23.92%, and 30-day gain of 24.90%. Its remarkable price performance has attracted investor attention [0].

- Significant Trading Volume Increase: On December 17, the trading volume was 71.85M, up 47.5% from the 30-day average volume of 48.73M, indicating a substantial increase in market participation [0].

- Fundamentals vs. Stock Price Divergence: The latest financial report shows EPS (-24%) and revenue (-14.74%) both fell short of expectations, contrasting with the strong stock price performance, which requires caution [0].

- High Valuation Risk: The current P/E ratio of 178.77x and P/B ratio of 26.92x are far above the industry average, indicating that the valuation is already at a high level [0].

- Lack of Clear Catalyst: No specific news or announcements explaining the December 17 daily limit were found; the upward momentum may mainly come from momentum trading [0].

- Risks:

- High valuation leads to significant pullback pressure [0];

- Divergence between fundamentals and stock price may trigger market doubts [0];

- Lack of clear driving events, so the sustainability of the rise is questionable [0].

- Opportunities: The thermal management industry benefits from the expansion of AI data centers, with broad long-term demand growth potential [1][2][3].

Envicool (002837.SZ) made it to the hot list due to thermal management industry trends and price momentum. Short-term market sentiment is optimistic, but attention should be paid to risks such as high valuation and divergence between fundamentals and stock price. Investors should continue to monitor industry dynamics, improvements in the company’s fundamentals, and changes in trading volume.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.