Analysis of the Impact of Space Power Station Technology Commercialization on Investment Value of Zhenlei Technology (688270) and Qianzhao Optoelectronics (300102)

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

China’s ‘Zhu Ri Project’ is also known as the ‘Space Three Gorges’, with a clear phased plan:

- 2025: Build a kilowatt-level space photovoltaic power station [1]

- 2028: Complete wireless transmission safety verification [1]

- 2030: Upgrade to megawatt-level [1]

- 2050: Build a gigawatt-level commercial space photovoltaic power station [1]

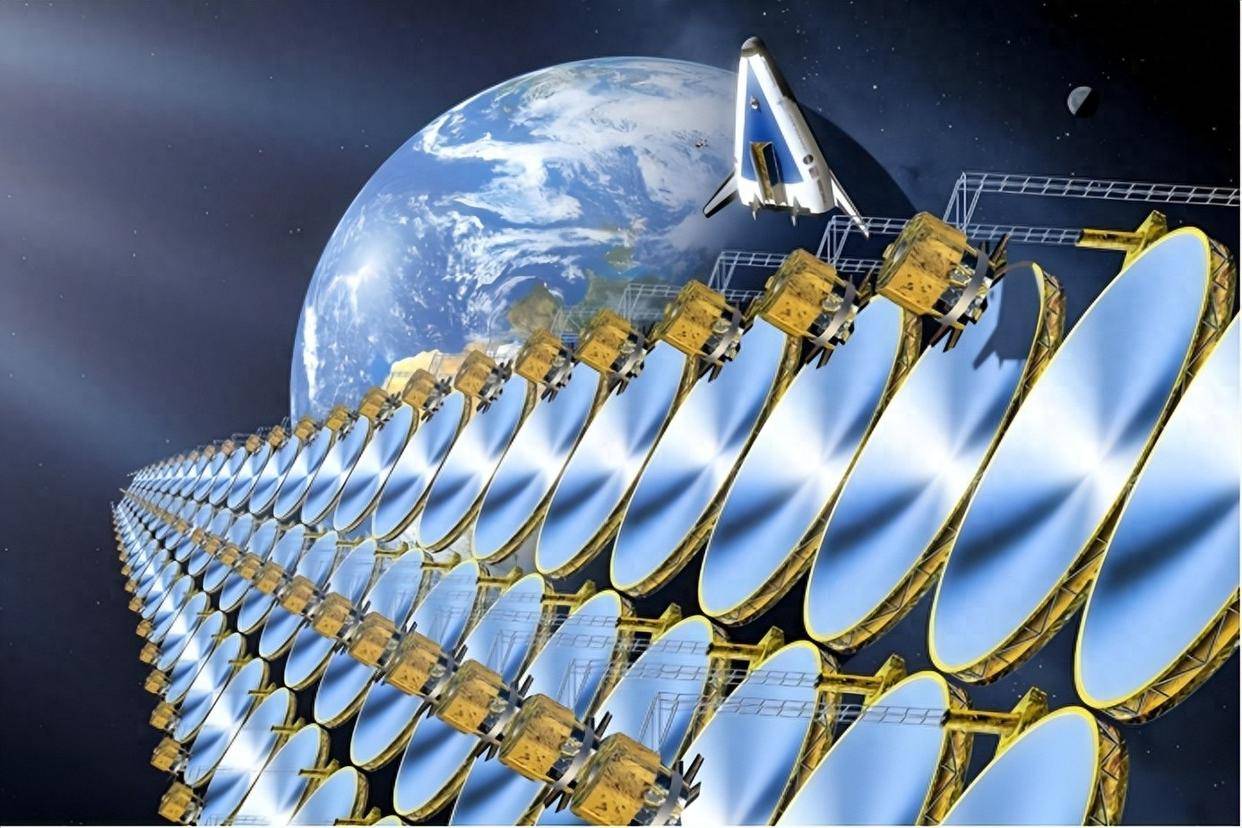

Space Solar Power Station (SSPS) mainly involves three core technologies:

- Construction Technology: Relying on China’s space station construction experience, it already has space assembly capabilities [2]

- Power Generation and Storage: Using gallium arsenide solar cells to achieve high-efficiency energy conversion

- Wireless Transmission: Transmitting energy back to Earth via high-power microwave energy transmission technology [2]

Zhenlei Technology focuses on RF integrated circuit design, with main products including:

- RF transceiver chips and high-speed high-precision ADC/DAC chips: Applied in digital phased array radar systems

- Power management chips: Used in satellite communication, regional protection and other fields

- Microsystems and modules: Applied in phased array antenna systems [3]

According to the latest financial data, Zhenlei Technology’s first-half 2025 performance was outstanding:

- Revenue: 205 million yuan, up 73.64% year-on-year [4]

- Net Profit Attributable to Parent Company: 62.32 million yuan, up 1006.99% year-on-year [4]

- Product Structure: Power management chips generated over 100 million yuan in revenue, and RF transceiver chips generated more than 80 million yuan [4]

Zhenlei Technology has first-mover advantages in digital phased array radar and satellite communication fields. Its phased array antenna system features

Qianzhao Optoelectronics is a leading domestic enterprise in gallium arsenide solar cell epitaxial wafers:

- Technical Accumulation: Over ten years of R&D experience, the earliest domestic enterprise to develop gallium arsenide solar cells [5]

- Efficiency Leadership: The fourth-generation space solar cell has a photoelectric conversion efficiency of 32%, and the fifth-generation reaches 32.5% [5]

- Flexible Batteries: Flexible solar cells with flexible bendability and high power-to-mass ratio have achieved mass production [5]

According to the latest financial data:

- First Three Quarters Revenue: 2.75 billion yuan, up 46.36% year-on-year [6]

- First Three Quarters Net Profit: 87.95 million yuan, up 80.17% year-on-year [6]

- Third Quarter Performance: Single-quarter revenue of 1.007 billion yuan, up 65.8% year-on-year [6]

Qianzhao Optoelectronics’ gallium arsenide solar cell products have been mass-applied in domestic in-orbit large commercial aerospace constellation networking satellites (such as the G60 Qianfan Constellation) [5]. The company stated that ‘all fields with energy demand in space applications can use the company’s gallium arsenide solar cell products’ [5], which lays a technical foundation for space power station applications.

- Accelerated Satellite Internet Construction: The company’s revenue from special industries and satellite communication fields is basically equal, each accounting for about 50% [4]

- Technical Barrier Advantages: First-mover advantages in the digital phased array field, with product technology reaching international advanced levels [3]

- Policy Support: Benefits from the development of strategic emerging industries such as commercial aerospace and low-altitude economy [4]

- Monopoly Position in Gallium Arsenide Battery Market: As the largest listed company in China that can supply gallium arsenide solar cells for satellite internet [5]

- Extremely High Technical Barriers: Triple-junction gallium arsenide solar cells require growing nearly 30 layers of epitaxy, and the complexity of the epitaxial structure increases exponentially [5]

- Wide Application Fields: Expanding from satellite internet to broader markets such as space power stations

- Uncertainty in Commercialization Timeline: Space power stations require a long time from technical verification to large-scale commercialization

- Strong Policy Dependence: Industry development is highly dependent on national policy support

- Zhenlei Technology: Gross profit margin declined from 87.40% in the first quarter to 84.54%, and profitability needs to be improved [4]

- Qianzhao Optoelectronics: Large accounts receivable, accounting for 1029.8% of the latest annual net profit attributable to the parent company [6]

- Zhenlei Technology: Benefits from accelerated satellite internet construction, with explosive growth in 2025 performance and strong short-term growth certainty

- Qianzhao Optoelectronics: Gallium arsenide batteries have been mass-applied in satellite constellations, with a clear performance growth trend

As China’s ‘Zhu Ri Project’ progresses as planned, the construction of megawatt-level space power stations by 2030 will drive significant growth in demand for related industrial chains. Both companies, as core suppliers, will benefit in the long term.

- Zhenlei Technology: Give a ‘Buy’ rating, focus on satellite internet construction progress and phased array technology breakthroughs

- Qianzhao Optoelectronics: Give a ‘Buy’ rating, focus on gallium arsenide battery technology upgrades and space power station project implementation progress

[0] Jinling API Data

[1] Zhihu Column - ‘How Awesome is China’s Zhu Ri Project? Building a Giant Power Station in Space, Making the US Worried!’

[2] Block Trend - ‘Moving the Three Gorges Dam to Space: China Plans to Build a Solar Cosmic Power Station’

[3] Zhenlei Technology 2024 Annual Report Summary - QQ.com

[4] Times Online - ‘Satellite Internet Boom? Zhenlei Technology’s First-Half Revenue Surges 70%, Executives Say Optimistic About Future Expectations’

[5] Sina Finance - ‘Qianzhao Optoelectronics: Gallium Arsenide Solar Cell Products Have Been Mass-Applied in Domestic In-Orbit Large Commercial Aerospace Constellation Networking Satellites’

[6] Tencent News - ‘Qianzhao Optoelectronics (300102) 2025 Third Quarter Report Brief Analysis: Revenue and Net Profit Both Grow Year-On-Year’

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.