Municipal Bond Market Rebound Amid Federal Medicaid Funding Cuts and State Budget Pressures

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

This analysis is based on the Bloomberg Television interview featuring Shannon Rinehart from Columbia Threadneedle [1], which reported that municipal bonds have recovered from a challenging start to 2025 but continue to underperform other fixed income segments.

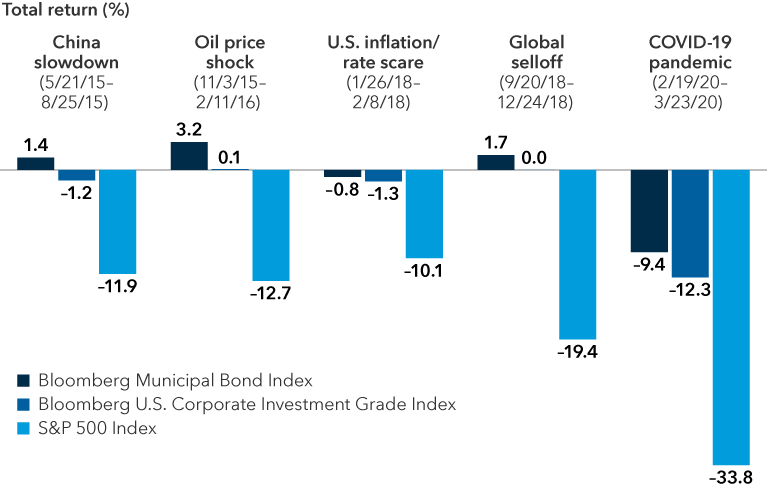

The municipal bond market presents a complex picture of recovery amid significant structural challenges. While bonds have rebounded from early-year volatility, their performance lags substantially behind other fixed income categories. The Bloomberg Municipal Bond Index returned -0.79% year-to-date as of July 29, 2025, compared to positive returns across Treasuries (3.60%), U.S. bonds (3.97%), investment-grade corporates (4.44%), and high-yield corporates (5.15%) [2].

The primary concern centers on federal funding reductions through the “One Big Beautiful Bill Act” (H.R.1), which cuts Medicaid funding by 15% or approximately $1 trillion over 10 years. The Congressional Budget Office estimates this will cause 11.8 million individuals to lose Medicaid coverage directly [3]. California faces particularly severe exposure, with potential impacts affecting up to 3.4 million people and costing the state $30 billion in federal funding annually [4].

Despite these headwinds, California demonstrates fiscal resilience with General Fund revenues $3.7 billion (1.6%) ahead of budget and up $18.1 billion (8.4%) above the prior year. Expenditures were $9.7 billion below budget (-4.3%) [5]. However, Medi-Cal (California’s Medicaid program) remains a major budget item, covering approximately 15 million Californians in 2024-25 and projected to cover 14.8 million in 2025-26 - more than one-third of the state’s population [6].

- State Budget Responses: Monitor how individual states respond to federal funding reductions through tax increases, spending cuts, or reserve utilization [5]

- Credit Rating Actions: Watch for rating agency downgrades, particularly for healthcare and general obligation issuers in high-Medicaid states [2]

- Federal Implementation Timeline: Track the phased implementation of Medicaid cuts and their timing relative to state budget cycles [3]

- Economic Indicators: Monitor employment trends in healthcare, education, and government sectors which may be affected by federal funding reductions [2]

The municipal bond market is experiencing a technical rebound from early 2025 weakness but continues to face fundamental challenges from federal funding reductions. While states like California demonstrate current fiscal strength through revenue exceeding budget projections by $3.7 billion and expenditures running $9.7 billion below budget [5], the long-term impact of $30 billion in annual Medicaid funding losses creates substantial uncertainty [4].

Investors should focus on issuer-specific analysis rather than broad market trends, considering factors such as Medicaid exposure, budgetary flexibility, and reserve levels. The current yield environment of 3.39% on national municipal bonds [7] may not adequately compensate for the emerging credit risks, particularly for healthcare-related issuers and states with high Medicaid enrollment.

The robust supply environment with $428 billion issued year-to-date [2] combined with potential credit quality deterioration suggests careful security selection will be crucial in navigating the municipal market through the remainder of 2025 and beyond.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.