Universal Scientific Industrial (USI) Limit-Up: AI Optical Module Catalysts and Risks Coexist

#涨停分析 #AI服务器 #光模块 #市场情绪

Mixed

A-Share

December 17, 2025

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

601231

--

601231

--

Comprehensive Analysis

- Universal Scientific Industrial (USI) was marked as a limit-up stock by tushare_zt_pool at 17:15 UTC+8 on December 17, 2025. The current price is ¥28.19, with a +9.99% increase and a trading volume of 41.23 million shares. The stock price also hit a new all-time high, and the 30-day average volume increased by 38.5%, indicating active pursuit by market funds [0].

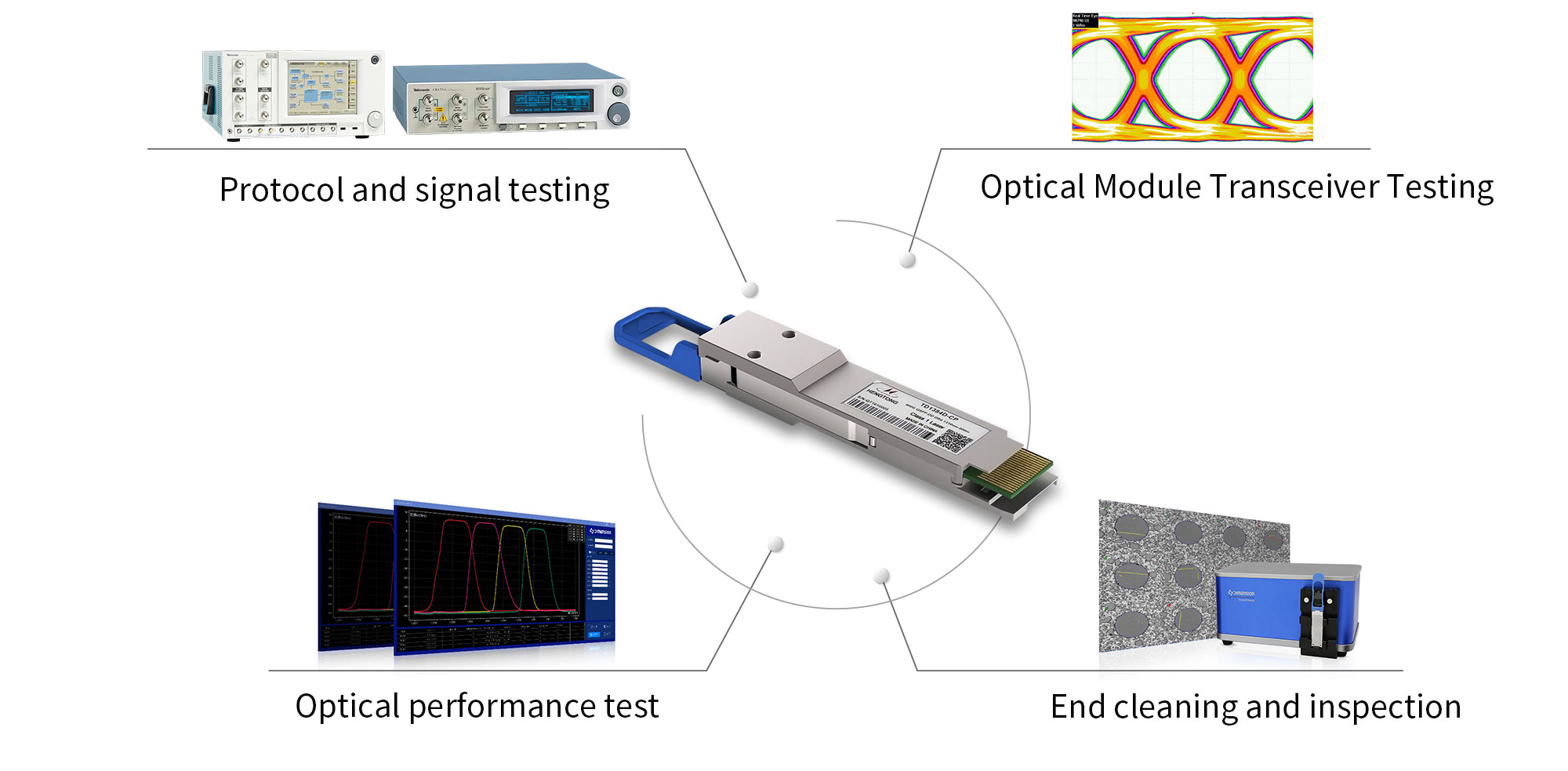

- The main catalyst for this limit-up is the company’s expansion plan for its second plant in Haiphong, Vietnam, targeting a monthly output of 100,000 800G/1.6T silicon photonics optical modules to meet the demand of high-performance AI servers and North American customers. It will further improve optical module packaging efficiency by leveraging SiP packaging patents and heat dissipation optimization [1].

- AI server industry chain prosperity continues: The server ODM index rose by 1.5% this week, with Wistron and Hon Hai conducting collaboration. Meanwhile, Chinese tech giants (such as Kuaishou and Alibaba) are increasing AI computing power spending, further boosting demand for upstream optical modules and server components [2][3][4].

- Price/volume and technical indicators show: The 6-month increase has doubled, MACD remains bullish, KDJ is overbought but the upward trend is to be confirmed. The support level is at ¥24.58, short-term resistance is the current price of ¥28.19. If broken, it is expected to test ¥29.54 [0].

Key Insights

- Supply-Demand Growth Driver: The expansion of AI server computing power drives demand for 800G/1.6T optical modules. Vietnam’s capacity and Hon Hai’s ecosystem provide delivery guarantees, strengthening the company’s position in the AI hardware supply chain [1][4].

- Technology Moat + Diversified Business: SiP system-in-package and multiple business lines covering smart wearables, automotive electronics, industrial electronics, etc., reduce single-product risk and provide stable cash flow [1][0].

- Valuation and Performance Misalignment: PE is about 38x and PB is 3.27x, which are at historical highs, but revenue and net profit in the first three quarters declined slightly year-on-year. Recent stock prices have already reflected future expectations in advance; the rally needs to be verified by performance recovery [0][1].

- Market Sentiment Driver: The limit-up order was not broken, and the superposition of AI+optical module concept labels has made trend-following funds active. However, short-term overbought conditions and profit-taking positions still exist, increasing the possibility of a partial pullback [0][1][5].

Risks and Opportunities

- Risks

- Technical indicators (e.g., KDJ J-value 102) suggest overbought conditions, and there is a high possibility of a correction or gap-up followed by a decline on the day after the limit-up [0].

- Valuations are already at a high level; if performance fails to recover quickly or the optical module ramp-up pace lags, it may be repriced by the market [0][1].

- Q3 revenue/net profit both declined, and profitability is low; short-term performance pressure remains. Need to monitor the speed of capacity conversion in Q4 and 2026 [1].

- Competition and macro factors: Competitors such as Luxshare Precision and Foxconn Industrial Internet are seizing AI server/optical module market share. In addition, Sino-US geopolitical tensions and exchange rate fluctuations put pressure on exports [5].

- Opportunities

- If the Vietnam optical module production line is put into operation as planned, it will directly enhance AI server supply capacity and support future revenue and orders [1].

- AI computing power spending continues to grow; Hon Hai’s collaboration with NVIDIA and parent company resources help secure orders from leading customers [3][4].

- SiP packaging barriers and multi-scenario applications (consumer, industrial, automotive) can diversify risks in different cycles and provide new growth points [1].

- If the price stabilizes at a high level and breaks through ¥29.54 smoothly, it can provide new momentum for trend-following funds, but need to observe the matching degree of trading volume [0].

Key Information Summary

- Time Background: Based on the event at 17:15 UTC+8 on December 17, 2025, the limit-up was captured by tushare_zt_pool [0]; external reports supplement information on optical module capacity, AI industry prosperity, and parent company dynamics [1][2][3][4][5].

- Fundamentals: First three quarters’ revenue was ¥43.641 billion, net profit ¥1.263 billion, net profit margin 2.68%, ROE 8.79%. EPS exceeded expectations but revenue was slightly lower [0][1].

- Valuation and Support/Resistance: TTM PE is 38.62x, PB is 3.27x; support levels are at ¥24.58/¥21.70, main resistance levels at ¥28.19 and ¥29.54; short-term strong stock price fluctuations need to be confirmed by trading volume [0].

- Industry Logic: Against the backdrop of high prosperity in AI servers and optical modules, SiP technology and Hon Hai’s resources form a moat, but need to continuously observe the feedback of capacity ramp-up and global AI spending trends on orders [1][3][4].

Ask based on this news for deep analysis...

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

601231

--

601231

--